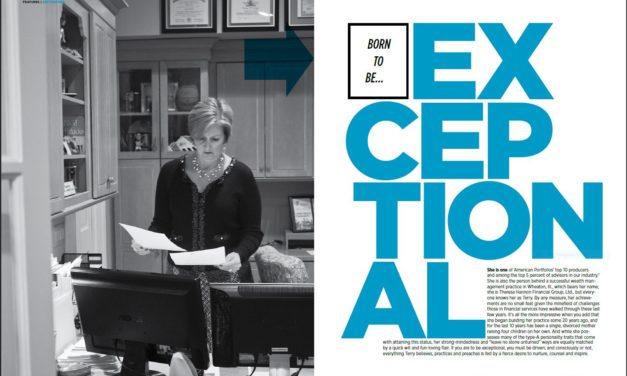

FREE 6.1 Feature – Theresa Hannon

Born to be exceptional. She is one of American Portfolios’ top 10 producers and among the top 5 percent of advisors in our industry. She is also the person behind a successful wealth management practice in Wheaton, Ill., which bears her name; she is Theresa Hannon Financial Group, Ltd., but everyone knows her as Terry.

Read More