FREE 10.2 Feature – Ronald Chakler

Chakler espouses a formidable work ethic. From the time he was 14 years old, he worked part-time in a bagel bakery making, you guessed it … bagels. As the saying goes, “you can’t keep a good man down” and, following his departure from the classroom, he fell back on his bagel baking experience after reconnecting with an old friend who was opening bagel shops near Atlantic City, N.J. Together they built three bakeries; however, following a falling out between the owners and the partners of the business, Chakler knew he wanted and needed a “real job.”

To view the full article please register below:

FREE 10.2 Feature – Ronald Chakler

Life move on.

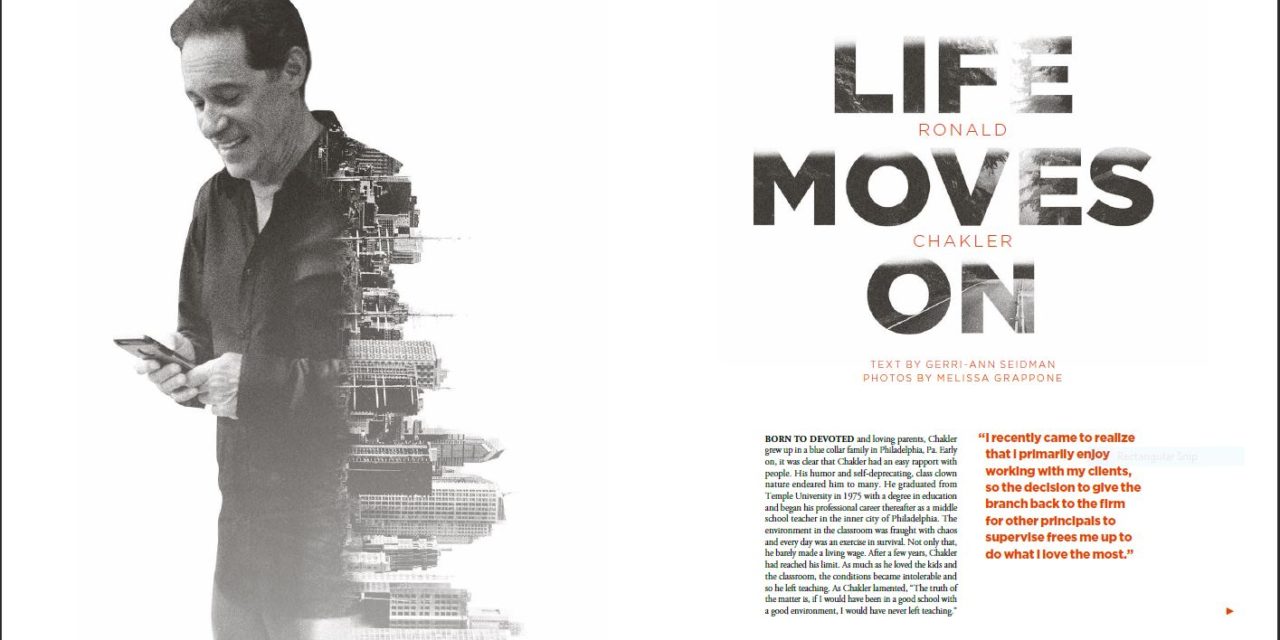

Born to devoted and loving parents, Chakler grew up in a blue collar family in Philadelphia, Pa. Early on, it was clear that Chakler had an easy rapport with people. His humor and self-deprecating, class clown nature endeared him to many. He graduated from Temple University in 1975 with a degree in education and began his professional career thereafter as a middle school teacher in the inner city of Philadelphia. The environment in the classroom was fraught with chaos and every day was an exercise in survival. Not only that, he barely made a living wage. After a few years, Chakler had reached his limit. As much as he loved the kids and the classroom, the conditions became intolerable and so he left teaching. As Chakler lamented, “The truth of the matter is, if I would have been in a good school with a good environment, I would have never left teaching.”

Chakler espouses a formidable work ethic. From the time he was 14 years old, he worked part-time in a bagel bakery making, you guessed it … bagels. As the saying goes, “you can’t keep a good man down” and, following his departure from the classroom, he fell back on his bagel baking experience after reconnecting with an old friend who was opening bagel shops near Atlantic City, N.J. Together they built three bakeries; however, following a falling out between the owners and the partners of the business, Chakler knew he wanted and needed a “real job.”

“My best friend was a stock broker and he said, ‘Why don’t you do this? You’d be good at it.’ Chakler made the decision and joined E.W. Smith & Co., a small financial firm in Philadelphia, which was later bought out by Gruntal & Co. Chakler became licensed in 1980 and stayed with Gruntal & Co. pushing proprietary products until 1992. While not terribly popular at the time, Chakler had friends who were forming a DBA called Tax and Financial Strategies; he joined the DBA, adding his expertise in investing to the mix. By 1996, he began to build his own branch. With a focus on accountants, the decision was made to form their own broker/dealer, Pinnacle Asset Management, which cleared through Bear Stearns.

By 1998, Chakler realized that running a small broker/dealer was an incredible amount of work. Looking to merge with a bigger organization that cleared through Bear Stearns, Chakler’s relationship manager introduced him to American Portfolios CEO Lon T. Dolber, who at the time—not unlike Chakler—had been building an OSJ for seven years, the last two of which were with Nathan & Lewis Securities.

“Lon knew how to flatter you,” recalls Chakler. “The conversation was always, ‘You’re going to be an asset to our organization and be a key piece of this great big puzzle we are trying to create. I’m going to make it worth your while, and I’m going to help you build your branch.’

Chakler’s extensive experience with general securities and the systems at Bear Stearns was invaluable insofar as training people that Lon brought on. Dolber would call Chakler every month over the course of 18 months, each time asking him to join the group, which would inevitably become American Portfolios, the independent broker/dealer.

By 2000, with a few of his colleagues, Chakler moved over to Nathan & Lewis under Dolber’s OSJ, knowing a year later they would have to transition again to AP. By 2004, when Chakler recruited a large group out of Wyomissing, Pa., it made him one of the Top 10 OSJs at the firm. Through the support of the systems and technology that AP had developed early on, Chakler could supervise his group while managing his own personal practice. That arrangement lasted for more than 10 years, until recently, in 2015, when Chakler decided to focus exclusively on his practice.

“I recently came to realize that I primarily enjoy working with my clients, so the decision to give the branch back to the firm for other principals to supervise frees me up to do what I love the most,” says Chakler of the business move.

For more than 25 years, Chakler has always felt comfortable working with individual middle class families, helping them navigate their investment goals. In so doing, he becomes an integral part of their family. His training as an educator has lent itself well to working with his clients. Imparting a big picture philosophy helps his clients understand the cyclical nature of the markets and minimizes their emotional responses. Chakler likens the ups and downs of investing to a relationship. “We’ve been through both good and bad times together and we’ve survived. When you go through these things together, it solidifies the relationship and you become much closer.” And, of course, Chakler’s disarming sense of humor allows clients to feel comfortable letting their guard down; it humanizes the relationship.

Like so many others, Chakler wears different hats in each role in his life on an almost daily basis. When his wife, Debbie, was diagnosed with cancer in 2011, yet another hat was added to the mix. Generally, those dealing with cancer are not thought of as fortunate, but Debbie was very fortunate. In addition to loving family members, she had a team of people by her side during her illness. Debbie knew she wanted to help those who were dealing with this illness by themselves—she felt it was her calling to help those who were less fortunate than herself. A non-profit called A Miracle for Debbie was established prior to her passing to financially help others struggling with cancer. Three years later, through this foundation, people are not only being helped financially, but spiritually, as well as keeping Debbie’s legacy and memory alive.

“There are advantages and disadvantages of going through a long illness with a loved one. The advantage obviously is nothing’s ever left unsaid. I know everything, how Debbie felt, and we had a lot of time to talk about it. There’s a saying I have, which is, ‘Opportunities can be lost in the blink of an eye, but regrets can last a lifetime.’ Debbie made me appreciate life.”

Chakler has also worked side-by-side with his daughter, Kristin, who, based on her experiences with her oldest son, Billie, wrote a book on Autism entitled, “I Have Autism and That’s Okay!” Published in 2013, the book was all about raising the level of awareness, early intervention, hope and acceptance for those facing the challenges of Autism Spectrum Disorder.

For Chakler’s practice, he still wakes up every day believing he plays a critical part in his client’s lives. The ability to create multi-generational wealth is not only an important and serious facet of what he does, it is also very rewarding. Despite a strong push for robo-advisors, he believes the interpersonal relationship that a financial advisor has with clients is invaluable and can’t be replaced. Chakler feels there will be challenges for advisors with the upcoming Department of Labor (DOL) regulatory changes. On the one hand, he understands and recognizes that as a result of the DOL changes, he must annuitize his business. While Chakler understands the client conversation will be difficult, he trusts the relationships he’s forged with clients over the past 25 years will help them understand.

As Chakler takes a deeper look at establishing a business succession plan, he agrees that annuitizing some of his revenue stream makes sense, whether it be through fee-based or C-share business. “I just think that’s the way the industry is going and, as you get closer to retirement, it seems like a natural evolution.” When asked about his succession plan, Chakler believes taking on a junior associate is definitely the beginning of what might be called a “succession plan.” And, while he doesn’t see himself ever really retiring, he laughs, “I don’t think my clients would let me.”

With a focus now on clients, family and forging new relationships, Chakler has moved onto the next chapter in his life, not to mention a new office in a charming, renovated, turn-of-the-century brick commercial home in historic Newtown, Pa. “I’ve had a lot of time to think about what I want to do with my life going forward. You don’t expect to ever be single at 60 and have to start over.”

Recently Chakler entered into a relationship with a woman who is a strict vegan. A good match in light of his desire to become more conscious about eating healthier, though he tries to be respectful of her dietary requirements when they are together, he admits he can never imagine giving up a Philly Cheesesteak.

“When all is said and done, all we have in our lives is our stories and our memories of things that happened to us. I love goofing on people and playing.”

A priceless story shared by Chakler is a conversation he had with his grandson, Billie, announcing his plans for the future.

“Soon after Debbie’s passing, my grandson tells me he wants to cure cancer because it ‘took my Mimi,’” Chakler recounts. “The other day he tells me, ‘I don’t think I want to be a doctor anymore.’ ‘Really, Billie? I said. ‘What do you want to be? He says, ‘I think I’m going to be the guy that dresses up in the costume at Chuck E. Cheese’s. I’m going to be the mouse, ’” to which Chakler responds, “That’s a good thing, Billie. You went from being an oncologist to dressing up as the rat at Chuck E. Cheese’s. Glad to see your aspirations are evolving.”

Perhaps there is hope for a Chakler family legacy in financial planning.