FREE 12.1 Feature – Barbara Treadwell

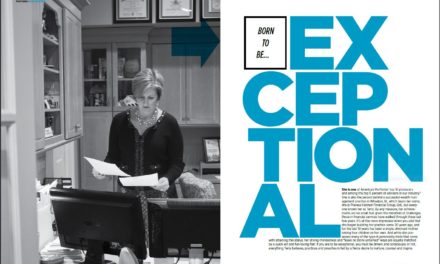

As the title might imply, while no truer words could ever be spoken enough about this woman, you will never hear her complain about work; nor will she ever imply her life is any more or less difficult than others, irrespective of gender. But what you will hear American Portfolios affiliated advisor Barbara Treadwell of Savannah, Ga., say is that she is an unapologetic workaholic who loves her life and what she does.

To view the full article please register below:

FREE 12.1 Feature – Barbara Treadwell

A Woman’s Work Is Never Done

Photos by Barbara Treadwell

As the title might imply, while no truer words could ever be spoken enough about this woman, you will never hear her complain about work; nor will she ever imply her life is any more or less difficult than others, irrespective of gender. But what you will hear American Portfolios affiliated advisor Barbara Treadwell of Savannah, Ga., say is that she is an unapologetic workaholic who loves her life and what she does.

“I don’t apologize for working hard anymore,” declares Treadwell, sitting across the table during an interview with her in August 2010 at The Olde Pink House, an 18th-century colonial mansion turned restaurant serving new Southern cuisine in the heart of Savannah’s charming historic district. “My life is my life. I have family and friends, community and work. I get up and think about what I can accomplish today and what would make me happy; and then, I just give it everything I’ve got, go to bed exhausted and wake up the next day.”

That is precisely what happened on one such occasion 18 years ago while away on business for an industry meeting with colleagues at this very same restaurant where Treadwell fell in love with Savannah.

“From the restaurant, I walked off a little porch onto Reynolds Square—one of 22 squares within the historical districts’ two-square mile radius— where a full moon hung in the crook of a 300- year-old oak tree dripping in Spanish moss. In the distance, I heard the sound of clomping horse hooves on cobblestone. It took my breath away.”

With curiosity piqued for a glimpse at some of the antebellum-style residences nearby, before returning to the airport for her flight back home to New York, Treadwell asked the cab driver to pass by three or four sites she had pin-pointed on a local area map. He recommended she meet Cora Bett Thomas, a known realtor in town. By her account, it wouldn’t be fate but chemistry and timing1 leading not just to the inevitable real estate transaction of a 4,000-square foot, three-story, high-ceiling row house with a courtyard and carriage house on a 10,000-square foot piece of property, but a friendship between these women that remains to this day.

And so, with furniture in tow from a two-bedroom, soon-to-end rent-stabilized apartment she lived in for 22 years overlooking the East River, Treadwell moved her residence down South. Years later, she moved her mother in, who enjoyed her own living space in the carriage house across the courtyard from her daughter for seven years until her death.

“Honestly, if it were any reason that I came to Savannah and had that house, it was that my mother would have a place to call home when my dad died. She loved being there. We had the best time. She would say to me, ‘I’m the luckiest old broad I know.’ She was 95 when she died.”

Remaining in New York were Treadwell’s children and grandchildren, along with the majority of her clients. It was the price to pay for being Lord of the Manor, but nothing that telecommunications, technology, telecommuting by her then in-house and now remote assistant Cathie, and monthly visits to New York couldn’t fix. And, for the little ones, there was the added bonus of spending summers with Grammie in her palatial home or a night at the Union League Club in Manhattan, where she stays and works to see family, friends and tend to her clients when up North.

It is a practice that began some 35 years ago, shortly after her divorce and a decision to leave a rewarding, yet emotionally taxing, career in Mobile, Ala., counseling terminally ill patients and their families. The takeaway from that experience brought to light the profoundly deficient financial planning conditions that existed for survivors. A visit with a childhood friend living in New York drew Treadwell to the excitement of the city and the opportunities it offered. She sought the help of a career counselor down in East Greenwich Village who engaged her in non-conventional career search practices, such as informational interviews calling on businesses in different industries seeking not employment, but instead a day at their company to see if she liked what they did. Those efforts soon became short lived when she answered a MassMutual ad for financial services. With an emphasis on selling insurance, while she had the brains and personality, an assessment for her success revealed she did not have a killer instinct and would inevitably fail. Treadwell admits she almost did.

“There is a feeling by men who run business and women who want to get into it that you have to be very, very tough. And you do, but it has nothing to do with being a woman; it is about overcoming rejection.” Treadwell continues, explaining a concept coined by Sid Walker, her business coach and author of “Trust Your Gut,” among other publications. “Absent of integrity and competence, it also comes down to chemistry and timing. In other words, if you meet somebody and you click, but the time isn’t right, no business will happen. Conversely, the timing can be perfect when somebody is ready to do business, but you just don’t click.”1 That lesson resulted in firing three of her nastiest clients. “I just decided I would do business only with people I liked … scary, but simple.”

While making no claim that the financial services industry is tougher for women, according to Treadwell, women in fact have a distinct advantage when it comes to giving financial advice, and helping individuals and families with savings and retirement. “Girl Power is so underestimated,” laughs Treadwell. “Personality traits such as intuitiveness, patience and listening usually forwards the action and solidifies the relationship.”

To augment these innate sensibilities, with an academic inclination, Treadwell pursued her securities licenses and credentials as a Certified Financial Planner (CFP), Chartered Life Underwriter (CLU) and then some; shortly thereafter, she fell in with a general agent at MassMutual named Howard Cowan who turned her around and taught her how to sell. Ten years later, Cowan introduced Treadwell to an economist named Robert Castiglione, whom she believes revolutionized her practice and the way she spoke to clients about their money. She became a Certified LEAP Practitioner4 in the Lifetime Economic Acceleration Process, a practice Castiglione developed more than 40 years ago for which he received written letters of acknowledgement from financial institutions, namely the Wharton School.

“I don’t worry about the markets. They will go up and down and there is nothing I can do about it because that’s what markets do.” With unflinching confidence, Treadwell leans into the conversation. “My job is to make sure I can protect my clients against the bad things that can happen to them. People hire me to watch their back. If someone loses their job, lives too long, dies too soon, becomes disabled, has a long-term illness, gets sued, the market plunges, taxes go up or inflation is rampant, I put protections in place so they can sleep at night.”

For Treadwell, everything in the financial planning realm has a LEAP process component, with cash flow being a No. 1 consideration. States Treadwell, “Until we understand money in and money out, we can’t begin to plan. People have no idea what they own or owe, earn or spend. The model works whether you are filthy rich or not.

With a strong foundation laid in financial and advanced insurance planning, after 26 years of hard work, she was very successful and fulfilled in her career; she was a MassMutual star, and one of only two women in company history to earn the coveted Chairman’s Club award and Exceptional Level of Insurance In Force (ELIF) recognition. At that time securities accounted for 10 percent of her business, with money management delegated to two third-party Turnkey Asset Management Programs (TAMPs) so she could focus on the personal client relationships.

“I love insurance and financial planning, but never thought of myself as a big investment person. Investments would simply allow me into a bigger conversation about financial planning, and that led me to insurance.”

Over time, Treadwell began to see changes at MML Investor Services that were not aligned with her business practices. As she became aware of other colleagues leaving the insurance broker/dealer (B/D), she learned that making a B/D change would not impede her ability—with the exception of proprietary product—to continue receiving her renewals and IRA monies she had in insurance product. With considerable trepidation, she decided it was time to make a change from what had served her well for 26 years and started doing her research. Her two conditions for consideration were that she could use her third-party TAMPs and LEAP/CFP for financial planning. Through the TAMPs, she sought out RIA relationships that worked with them, one of which was American Portfolios Advisors, Inc. (APA).

During Treadwell’s due diligence process of B/D firms, her general agent, long-time colleague and friend Howard Cowan introduced her to an up-and-coming young investment professional, William Platt, whom he had been mentoring just as he did with her 20 years prior. Recalls Treadwell of her conversation with Cowan, “He said to me, ‘although decades apart in age, you and Will have very similar philosophies and work ethics. He loves securities, and you love insurance, and perhaps you can work together.’”

Not only were there mutual benefits gained for new business by pooling their expertise, the relationship would also serve well for Treadwell during her transition to her new B/D, with Platt acting as her point man for the proprietary products she would not be able to bring over. After speaking with AP President of Sales and New Business Development Tim O’Grady, followed by thenpresident of APA Tom LoManto, AP Compliance Officer Martin Wendel and, finally, OSJ Manager Jane Desmond, she was sold on AP.

“I made my decision based on the people I met. It was drop dead cooperation, caring and commitment at AP. All this time I thought compliance was a terrible cross that you had to bear. Martin was so helpful … and so funny.” She recalls the conversation, laughing at the irony, “A compliance person with a sense of humor?”

Her new-found protégé and colleague, Will Platt, was so impressed with her experience at AP that he too transitioned over one year later. So much for having a point person on the other side. But she couldn’t be happier for him and the opportunity to continue working together. Credentialed as a CFP and Certified Fund Specialist (CFS), Platt would act as her investment counterpart. Four years later— unbeknownst to her—she would assume that role, introducing and speaking about investments first hand to her clients; although, not before seeing her way through a terrible personal loss.

At the end of 2012, two-and-a-half years after situating her practice with AP, Treadwell’s 41-year old son, Terry, died unexpectedly. Physically and intellectually disabled since birth, her life was dedicated to his care and quality of life. With the expectation her son would outlive her, all of Treadwell’s estate planning was reflected in that natural assumption.

Grief stricken, she acted on the advice of a friend and business colleague, John OcWieja, who directed her to Eastern philosophy insights. A YouTube video from a Dr. Baskaran Pillai—a researcher, scientist and engineer—talked about the power of combining science and spirit. That led to a YouTube meditation program, followed by a response to a question she submitted; that turned into a two-hour scheduled call with a Siddha in India named Hanuman Das to talk with her and perform an honorary ceremony called tarpanam on the one-year anniversary of her son’s death.

With scepticism going in, she had planned out the rest of her day to do some kayaking after her call. Through interpreters, the Siddha shared personal insights about her and her son, and talked to her about dealing with death and how the work of healing is intended to be hard, long and solitary. So completely different than her counseling practice from years prior, for Treadwell, the irony was not lost on this so-called “therapy.”

“It was an unbelievable experience,” says Treadwell earnestly. “After the call, when I left my mother and got in my car, I hauled off my kayak and I rode and rode and rode, and paddled and paddled. I then pulled over to shore, had my wine and my sandwich— and then, it was gone. The grief was done. It’s not that I wasn’t sad, but that cloud was gone. It just lifted.”

Not only did Treadwell continue her monthly calls with the Siddha for 11 more months, she began healing slowly, methodically and productively for the next five years. “Work for me during those years of coming up from the grief was my salvation. It was the place where I could leave mourning for a while and concentrate on others; really be with people, help them and figure out what would work for them. Helping others helped me heal myself.”

Two years later, in 2014, her business relationship with the colleague who had supported the investment side of the practice ended when Platt decided to start up his own RIA and affiliate with another B/D. Treadwell had no interest in making such a change and was now faced with finding a new resource to service and represent her mutual funds business. Treadwell’s OSJ Manager, Jane Desmond, convinced her to consider using one or two of the asset managers on APA’s Nine Points Advisory Services Platform. Desmond connected her with Vice President of Sales Ken Aulbach to help her position herself with a new investment solution to replace the mutual fund management her former colleague was providing.

“Ken said, ‘So here’s your new story. You want to talk to your clients about a portfolio of individual stocks and bonds; they are now grown-ups, they have a lot of money and they should be partaking in professional money management.’” Aulbach introduced Treadwell to Kevin Kern, a co-founding partner with Dr. Charles Lieberman of Advisors Capital Management (ACM). As a result, the relationship has totally changed her business in ways she never imagined would be her new focus and emphasis. Before joining AP in 2009, the ratio of insurance to investment business was 90/10. Today, it is 60/40, with plans to shift that even further.

“Doing advisory business managed by ACM has elevated me exponentially. It was a brand new experience. I totally understood when I saw the difference between mutual funds and their embedded fees and the transparency of a [portfolio of] individual stocks and bonds [professionally managed] with an asset under management fee; it made all the sense in the world.”

With the support of ACM’s proactive resources and highly-qualified investment management team— providing weekly economic and market commentary e-mails, webinars,regularly-provided client reviews and consultations—Treadwell’s clients were, and continue to be, very receptive to the way she now handles their investments, with all but two clients moving over to the professional money management solution. In fact, many of her clients are giving her investment referrals, something that happened only sporadically prior to doing advisory business on her own.

The change in her practice has created efficiencies with cash flow continuity and process execution, factors that, despite the occasional large payout, play out poorly when writing insurance business. “Selling insurance is hard work. You have underwriting problems out the gazoo. Sometimes it takes a year before you get paid.” Treadwell pauses, then laughs. “Now with advisory, I get paid every three months. They keep sending me money. I cannot get over that.”

As it relates to efficiencies in her life, she has streamlined that, as well. Over the course of five years, she sold her car and her kayak, her 10,000-square foot property and all of the rental properties, with the exception of one—a 1,450 square-foot home, also in Savannah’s historic district. Her designer, Mark Gazaway, has directed a one-year massive renovation, which is still in progress, with authentic Indochine décor, captivating Treadwell’s love of travel, particularly in the East.

And, when it comes to succession, for the occasional client who shows cause for concern should Treadwell stop working, as her sights have not been set any time soon for retirement, she does have a business continuity plan formally prepared that lays out exactly what must be done with her practice in the event of accident, illness or death.

“When this renovation is complete, and I have finally paid for it, I will have created a life with everything I love including my grandchildren, Harley and Rocco, my career, my little Indochine house, friends and travel.”

Unable to imagine life without her girlfriends, Treadwell unequivocally proclaims, “There’s nothing like ‘Girl Power.’ Guy friends are great… girlfriends ROCK!”

Not surprisingly, like her mother, it would appear Barbara Treadwell is one lucky lady. “It’s like a brand new beginning. Who would have thought at 74? I just think that’s amazing.” And so, the old English saying about work might go: The Golden Years may be just reward, but not for one unstoppable broad.