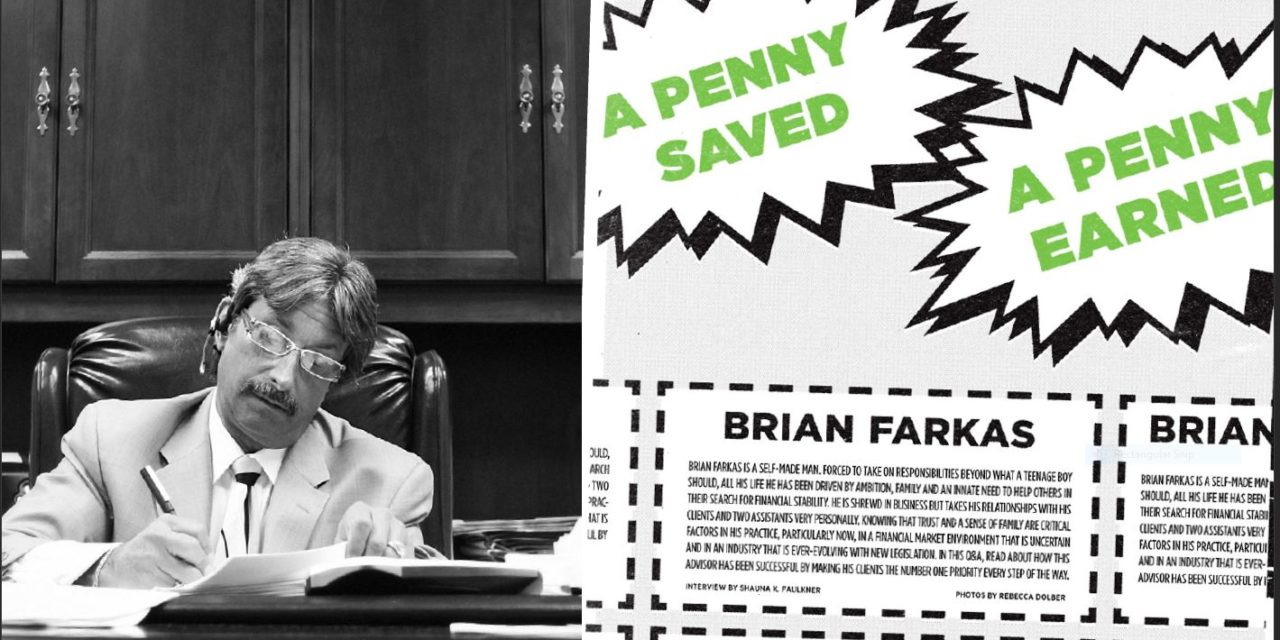

FREE 6.2 Q&A – Brian Farkas

Brian Farkas is a self-made man. Forced to take on responsibilities beyond what a teenage boy should, all his life he ahs been driven by ambition, family and an innate need to help others in their search for financial stability.

To view the full article please register below:

FREE 6.2 Q&A – Brian Farkas

A Penny Saved, A Penny Earned.

Brian Farkas is a self-made man. Forced to take on responsibilities beyond what a teenage boy should, all his life he ahs been driven by ambition, family and an innate need to help others in their search for financial stability. He is shrewd in business but takes his relationship with his clients and two assistants very personally, knowing that trust and sense of family are critical factors in his practice, particularly know, in a financial market environment that is uncertain and in an industry that is ever-evolving with new legislation. In this Q&A, read about how this advisor has been successful by making his clients the number one priority every step of the way.

FREE: How did you become interested in financial services?

Brian Farkas: It was a long journey for me. Back in 1971, my dad passed away and left my family with no money. I was 16 years old at the time, and was suddenly responsible for supporting my mother and sister; I was forced to learn about money at a young age and had to figure out a way to pay off the debts we were left with. I was constantly reading the paper about Dreyfus, Fidelity, investing money and paying off debt. I began to learn about investing. With a lot of determination and hard work, I had us out of debt by 1974.

FREE: Wow, debt free after only three years! How did you accomplish that?

BF: Hard work, and lots of it. At 16, I went to work for the New York Times, as my father previously had, working the printing press. Over time, I also came to work in a gold shop; gold had hit $800 an ounce for the first time, and there were lines wrapped around the block at nearly every gold shop. I worked for my best friend’s father. I was also running a disco business at night. I would do the gold shop during the days, work the disco business on weekend nights, and work at the New York Times all of the other nights. I was about 23 by this point, and very ambitious.

FREE: Working three jobs is impressive. At what point did you begin your official career in financial services?

BF: Well, in ’77, I began paying attention to some ads in Newsday for First Investors, where APFS CEO Lon Dolber actually got his start. I liked what I knew of the financial services business so far, and had it in mind to get into the stock business. I went to one of the advertised seminars, became interested and started working in the city. It wasn’t for me, though; and so, I went back to what I was doing. While there wasn’t anything wrong with the job, I just didn’t feel it was the right fit for me. I felt I had a different path that I was meant to travel. As it turned out, I was right.

FREE: What was that path?

BF: My best friend’s father, the one who owned the gold shop, suggested that we go into business for ourselves; he even offered to put up the money for us. That very night, while thinking about possibilities for a business I might be interested in owning, my sister called me. She told me that my uncle Alan was dying and she wondered if I knew of anyone who might be interested in buying the Manhattan Penny- Saver, which he had started. I told her, yeah, I would buy it. I used my own funds to purchase the publication; I was 25, and actually bought it as a birthday present to myself. I made the publication one of the more successful in the city in only a couple years. I also realized that many people were using our ads and going to other printers to have them printed, so my friend and I finally joined together in business to start a printing company. Both ventures were very successful, but there was still something missing for me. I wasn’t fully happy. I wasn’t helping people, and I knew that’s what I wanted to do most. So I walked away, and decided to give financial services another try.

FREE: Did you find this attempt more successful than the first?

BF: Absolutely, though it hasn’t been without its bumps. In the beginning, nobody would hire me except for two companies: First Investors and David Lerner Associates. I chose David Lerner, got licensed and never turned back from my decision to become a financial advisor. I only stayed with David Lerner for a year and in 1996 I went independent; I felt that’s what would be best for my customers. Still, there were some struggles, because I couldn’t find a company I was truly happy with. Not until 2002, that is, when a business associate walked into my office after hearing me express my unhappiness with my current broker/ dealer and said, “Brian, I’ve got a company for you. I want you to meet Lon Dolber from American Portfolios.” I met him and joined in March 2003. The rest is history; everything I had been through was just part of the search that led me to AP.

FREE: What was the biggest draw for you that made American Portfolios stand out from the rest?

BF: There is the convenience factor of having a broker/dealer here on Long Island. But more than that, it’s the technology. When Lon walked into my office, I was very impressed with the systems he had in place. He sat at my desk and showed me Albridge, and of course STARS, which has definitely made life easier. Lon and American Portfolios remain very focused on technology, and on being one of the front-runners in our business.

FREE: In your many years in this business, what have you noticed to be the biggest change?

BF: For me, the biggest—and most important—change in the business is in how we serve our clients. In the volatile world we’re in, the first priority is to do what benefits the client. In the old days, it seemed you could buy someone a mutual fund and five years later, their money was doubled. It doesn’t work like that anymore; things have evolved, and advisors need to keep current with the changes taking place. Advisors need to be tactical money managers today. The world is much more complicated than it used to be, particularly after the crash in 2008. People don’t want to lose more of their money. We, as advisors, need to do better for our clients.

FREE: To that end, what are you doing to make your business “better” for your clients?

BF: One of the things I’ve been doing recently is introducing fee-based products into my mix of product offerings. I believe this could be beneficial to those clients who want investment management through thirdparty managers. A wide variety of styles are offered and, rather than the client incurring transactional costs and commissions, fees are based on the value of assets under management.

FREE: It sounds like you’re very focused on the interests of your clients. What sets your practice apart from others?

BF: What sets me apart from others is trust. My clients trust me because I am transparent and open. If you’re not honest with your clients, it doesn’t matter what you do. They deserve respect, honesty and all the courtesies that we expect for ourselves. Customer service is also a priority; clients come first with us, and they always will. I, and my assistants Debbie and MaryAnn, promptly return phone calls; and if they want a callback at 8 p.m., I’ll call them at 8 p.m. I even take two annual trips to Florida’s east and west coasts to visit all of my clients living there. If I don’t, someone else will. I want to make sure that they will be the ones raising their hands when asked at a seminar if they have seen their advisor since leaving the Northeast.

FREE: What is the most fulfilling part of the job for you?

BF: Knowing that I’m helping people. When I get a card like I recently did from two dentists, thanking me for the personalized service, and how my moral and ethical character sets me apart from others; or, when I receive calls thanking me for my work, the challenges I face with the market and the industry make it all worth it. To me, these clients are a part of my family. Debbie, who has been with me 12 years, and MaryAnn, for 11 years, are a team, a family, and the clients feel this. When they call or come into the office, Debbie and MaryAnn ask about them, their spouse and their children— and by name. Our clients know we are all part of an extended family, and that’s incredibly fulfilling.

FREE: When not working, how do you like to spend your personal time?

BF: I love cars. I like to travel, and frequently to and from Florida. I like to garden and decorate; I’m always changing things up in my house and trying new things. I have several collections: I collect Swarovski crystal, and have all of the Christmas crystals going back to 1993; I collect Danberry Mint collectible muscle cars; and recently started a somewhat interesting collection of BIC lighters. I have all the colors, all the horoscopes, Yankees, Mets, Giants, Jets, Playboy and NY Rangers sets. I’m up to more than 80 BIC lighters.

FREE: What is your dream car?

BF: Honestly, while I appreciate cars, I’m kind of past planning for the perfect car. To me, and after everything I’ve been through, it seems materialistic. There’s nothing I really want or need anymore; I’m happy where I’m at, with what I have. I just want my health and happiness. That’s all I want for anyone else, too, for them to be happy and healthy. Life is about so much more, which I’ve learned. The material things don’t matter. I want the world to be different, for the fighting to stop, for everyone to find jobs and for people everywhere to feel safe and secure.

FREE: I’m sure everyone could agree with those last sentiments. What about your future? Is retirement anywhere in your plans?

BF: I don’t see myself retiring. I would eventually like to move to Florida, or at least split my time so that I’m spending 10 days there for every four days here. But as far as retiring all together, I don’t ever see that happening. I’ve been working for so long. Besides, I love

helping my clients and being there for them, so I don’t

think I’ll ever stop.

FREE: It’s been a pleasure, Brian. Thank you so much.

BF: Thank you.