FREE 8.2 Q&A – Ron Bergmann

Many estimates for renewal energy growth were made prior to the onset of the COVID-19 pandemic and the collapse in oil prices. Worries are building that with cheaper oil and a sustained disruption in global supply chains, renewable energy may lose momentum.

To view the full article please register below:

FREE 8.2 Q&A – Ron Bergmann

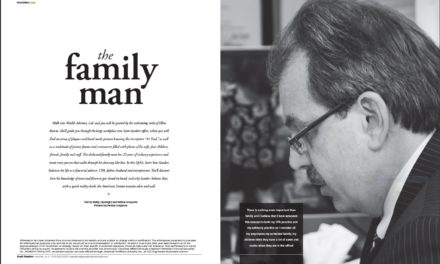

High Fidelity – Ron’s Way.

To paraphrase ‘ol blue yes: He says things he truly feels and not always the words you want to hear. The record’s clear. He’s got a top financial career doing it Ron’s way.

Affiliated colleague Ron Bergmann is no pushover; you’ll be hard pressed to get him to do anything your way. Yet, 23 years ago, APFS CEO Lon T. Dolber convinced Bergmann to go his way— when his options were many—on the road to independence. His business is his being and those close to him can appreciate it … and, ultimately, accept it. With a value system of loyalty and accountability learned as a young boy growing up in Manhattan’s inner city, Bergmann plays only to the tune of his personal conscience. To know him you must get past his sardonic wit— that’s his test. But once you do, you’ll be a friend for life.

FREE: How did you start in financial services?

RON BERGMANN: Thirty-four and a half years ago I was working for Bloomingdales in Manhattan as a buyer for china and glassware. It was a wonderful opportunity and something my brother was doing. But after awhile, I wanted to make a change so I answered an ad at First Investors. I never saw myself as a salesman, much less selling an intangible. Despite everyone telling me I was crazy for leaving a job with a pension, I thought I might actually be good at this. My mother-in-law told me, “If anybody could make a career in sales, my God it is you. You just don’t shut up.” She and my wife Rosemarie were the only two people who believed in me then.

FREE: How is it that you ultimately joined with CEO Lon T. Dolber to go independent?

RB: By the late 1980s, there were several of us from First Investors, including Lon [CEO, Lon T. Dolber], who would often talk about what it would be like to conduct business as we saw fit without the pressures of having to sell proprietary product. How could we increase the value of our practices through a shared equity ownership proposition? It was a tough decision to move to the independent channel but in 1991 four of us left First Investors—Lon T. Dolber, Gary Grappone, Denis Murphy and myself—to affiliate with then independent broker/dealer MFI Investments under Lon’s OSJ (Office of Supervisory Jurisdiction).

FREE: So would you say your practice really took off after you left First Investors?

RB: It was underway when I was at First Investors and I was building a nice foundation. But as the years go by you expand and grow. You become more of a tactician in your practice by honing your skills; and when you increase the number of arrows in your quiver, you can go out and hunt a little bit better.

FREE: What’s your most vivid memory of that first day at American Portfolios, Sept. 11, 2001?

RB: I remember sitting in my office with Lon; he was leaning back, as only he can do, with a frozen stare. We had just become the broker/ dealer, we didn’t even get our company off the ground and he looked at me and he said, “I’m not sure we’re going to make it. All of our hard work and dedication may never come to fruition.” Of course, it did and look what’s happened since then.

FREE: What life lessons were learned growing up in the inner city of New York?

RB: Stickball. You took grandma’s broom and you cut off the end of it. Then you’d get a Spaldeen for nine cents that everyone chipped in for. The west side of Manhattan was a tough place to go to school. There were people from all different persuasions. But we were friends and we watched each other’s backs. That’s how you made it. That’s where and when I developed my values.

FREE: How did you meet your wife, Rosemarie?

RB: After my family moved to Astoria, Queens, we lived a block away from each other. As it turned out, our grandmothers actually knew each other. If I try to paint a picture of my life without Rosemarie, it would have a whole different meaning. We’ve never deviated from the things that were most important to us—that strong sense of family.

FREE: Tell us about your practice and value proposition.

RB: Currently, I have about 1,250 clients with a little more than $200 million in combined total assets under management. Although my client’s return may be slightly less than what somebody else could have delivered, I’ll tell them, “You tell me what keeps you up at night and I’ll design investment strategies that will allow you to sleep soundly. That’s the value promise I am making to you.”

FREE: How have you been changing your practice over to a fee-based model?

RB: At the end of 2007, I obtained my series 65 license and in 2008 I started to do some fee-based business. Do I need to tell you how that turned out? As an advisor, no matter how good you are, unless you are a CFA (Chartered Financial Analyst) with a team of individuals behind you researching stocks and bonds and making those trades, you will be hard pressed to do this work and service your clients at the same time. Through AP’s advisory services platform [Nine Points], I use Manager’s Choice— known internally as the 19T office range—or Advisor’s Solutions—the PK7/PK8 office ranges. These institutionally-managed solutions allow an advisor to be out on a client call rather than glued to a computer screen.

FREE: How do you open a dialogue with your clients about fee-based business?

RB: You engage them by first getting them to understand how it works. As time passes, the opportunities will present themselves. For example, a client retires and has a frozen 401(k) plan from a former employer. Rather than just investing it in a traditional mutual fund or variable annuity, I’ll suggest putting it in a managed account that allows me to take the client through doors I wouldn’t ordinarily be able to open on my own. I’ll use a manager on the 19T program for a stock selection or a manager that has a specialty in a large-cap value portfolio, or a bond laddered portfolio. I demonstrate how this allows me more time to manage the client relationship while allowing the money manager to manage the asset.

FREE: From what you are describing, it sounds as if fee-based business has several advantages?

RB: When you sell a mutual fund to your clients, everyone is going to have the same identical position. Somebody can buy something in June, but the price may have gone up 20 percent from January to May. Then, in December, they realize an asset in their portfolio has phantom income or capital gain treatment that is assessed to them when they never even realized the profit. However, when you have two or three managers that you’ve put together in an advisory account, the stock positions are not part of a sleeve where gains are embedded in them; rather, they have their own cost basis that is unique to the individual who owns the account. That’s where I see the value of an advisory account.

FREE: So have you found clients or accounts that warrant going from transactional to fee-based?

RB: I currently have a little more than $30 million in fee-based business, practically all of which is new money. Where appropriate, and where it helps to augment the portfolio, that’s where I see the opportunity to do advisory business. For example, if I acquire a client who has Fidelity or Vanguard accounts worth $700,000, I look to see if there are unrealized losses embedded in the portfolio, and where the client could benefit from tax harvesting. By doing this, the portfolio can be reconstructed to potentially increase the return and reduce the risk. Like anything, you need to have balance.

FREE: What criteria do you use when selecting a money manager?

RB: I’m always doing research. I like selecting managers who buy individual securities that are not one style of management—not large-cap value or small-cap growth—rather, an all-cap type of investment. You need to analyze their expense ratios and, yes, their returns. That’s what I get paid to do. When someone asks me, “What do I need you for if I have an institutional money manager?” I say to them, “Who does the research in choosing the right manager for you? Who stays on top of the manager? I want to talk to that manager and know exactly what they plan to do because past performance is fleeting.

FREE: What does it take to be a successful business owner?

RB: The same way a restaurant owner or dry cleaning store does, at the end of the day, if the cash register isn’t ringing and you don’t have a profit, you’re out of business. My business is a growing entity that requires good support. So when you hire your employees, they have to be loyal to you and there has to be mutual respect. Currently I have two wonderful assistants. With the next generation coming through the practice, I can’t conduct business the way I’ve traditionally done it. Young people today don’t look at their watch to fi nd out what time it is; they look at their smart phone or tablet to get their information. You need to have people in your operation who can help you draw in that new generation of investors.

FREE: You are viewed by your peers as the consummate financial professional. What drives you to strive for such excellence in your craft?

RB: Being viewed in that way is the ultimate compliment. What I bring to the table is the ability to be available and accessible to them, and to be their financial life coach. Most importantly, the measurement of excellence goes back to value, self-respect and how people view you. When you wake up in the morning and look in that mirror, you want to feel good about the face that’s looking back at you. After 34 years of being in this business, I would like to think I’ve done it right.

FREE: Who or what has been your inspiration?

RB: My dad. He was not a wealthy man or highly educated, but he was wise. When he passed away, he left me a letter that said, “If there is one thing I gave you that is yours to keep and cherish, it is your name. What you do with it is going to define you as a man. It has a value only to you.” I’ve taken that message into my personal and professional life.

FREE: Your passion for the business may be equally matched or rivaled by your love of family. How are you and your wife faring in your new roles as grandparents?

RB: A client years ago said to me, “If I had known grandchildren were going to be this much fun, I would have had them before I had my own children.” Our oldest grandchild, Jason, will be four in July and our little princess, Jaclyn, turned two years old on April 23. It’s the beauty of their innocence that makes them so special; and as grandparents, you can just spoil them.

FREE: This issue’s theme is about capitalizing on your business partnerships. How do you determine who that will be?

RB: When someone comes in to me and says, “I would like to be a partner in your business,” I ask them, “Where were you 30 years ago when I was starting my business?” The only partner I have is the one I go home to every night. However, I do have sound relationships that I can call upon to work with that will help me realize my client’s goals. I have it in AP, I have it with my colleagues and I have it with product, asset management and service providers that I choose to work with.

FREE: Do you have a business continuity plan in place?

RB: Four years ago, one of my colleagues—Rick Cross—and I formed American Premier Financial Group. The relationship has really grown and is one that I think will be even more meaningful in the future. We cover for each other and use American Premier to solicit joint business. We also have a Web site that we drive our existing and prospective clients to that demonstrates a team of financial resources: Rick and myself as the financial planners, an accounting professional, estate planner and our combined service staff . I have a client from California that’s never met me in person, but if he goes to our American Premier Web site he can see our organization and know that we are a viable financial services organization.

FREE: Word has it you love cars and own some special ones. Any plans to take your grandkids out for a spin in them?

RB: My family snickers thinking about the day when Poppy takes the kids out for ice cream to witness the cone falling on the original car mat and having to bite my tongue in front of my grandchildren. I have a 2005 Corvette and a 1996 911 C4S Porsche Carrera. They are special cars, but really only special to me. I do love cars and in my perfect world, if I could have any one I wanted, it would be an Aston Martin DBS.

FREE: Where do you see yourself professionally and personally in the next five to 10 years?

RB: I am very realistic about who I am. I’m the most narcissistic person you’ll ever meet; and, while I don’t have a problem about getting older, I do have a problem with people thinking that because I’m 62, my level of performance will be affected and that I should retire. When you’re not doing the things that you do best and love, you worry about losing that fi re in your belly. My goal would be to change my practice in a way where I didn’t have to work 65 or 70 hours a week. Rosemarie tells me, “When I get that call from the office to come and collect you, and I ask what your last words were, they’ll tell me you said, ‘I can’t go yet, I have to finish this order.’”

FREE: Do you think you are a workaholic?

RB: It’s very hard to turn it off . I love this business. I don’t always look at the clock to see whether it’s time to go home and, often, I miss dinner. I always want to do the right thing. Sometimes we get our priorities mixed up. I think I have done a poor job balancing my home life and the time spent in my practice. In my wife’s words she “would rather have fewer possessions and more time with me.”

FREE: Speaking of your family, what trip do you have planned this summer with Rosemarie?

RB: It will be our 40-year anniversary this August and so we were planning on doing something with the entire family; however, our daughter Jennifer is expecting her second child in September. If ever there was a reason to skip or change our vacation plans, I can’t think of a better one.

FREE: Congratulations, and thank you for your time!

RB: Thank you.