FREE 11.1 Q&A – Mark Gajowski

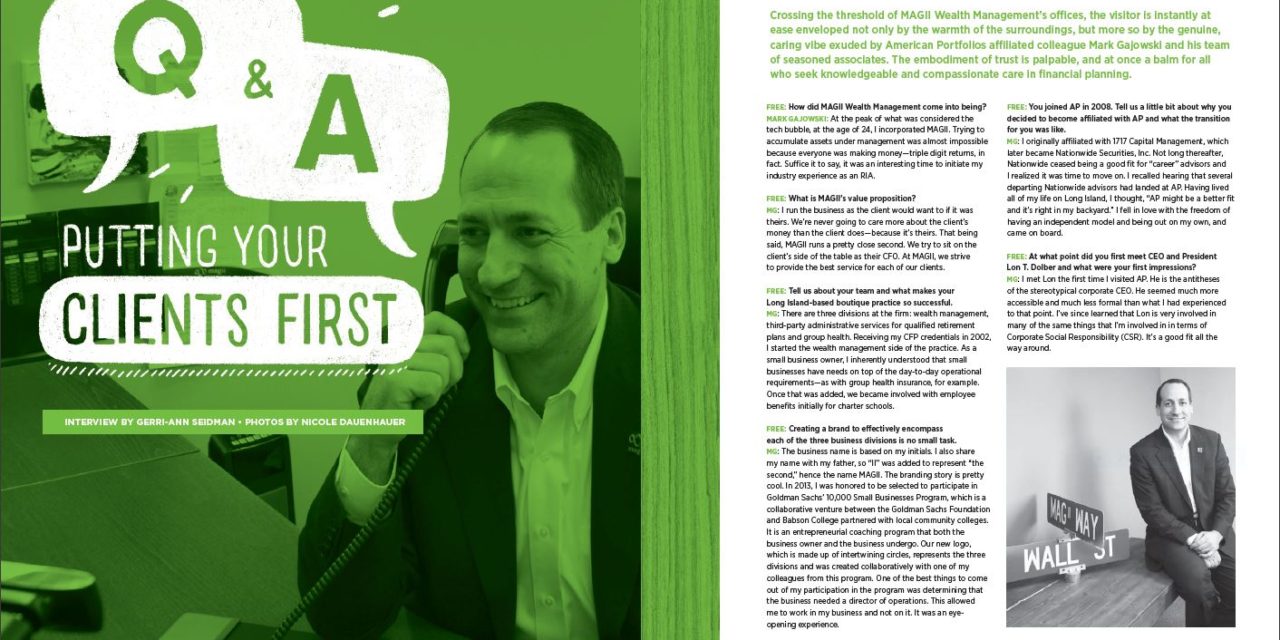

Crossing the threshold of MAGII Wealth Management’s offices, the visitor is instantly at ease enveloped not only by the warmth of the surroundings, but more so by the genuine, caring vibe exuded by American Portfolios affiliated colleague Mark Gajowski and his team of seasoned associates. The embodiment of trust is palpable, and at once a balm for all who seek knowledgeable and compassionate care in financial planning.

To view the full article please register below:

FREE 11.1 Q&A – Mark Gajowski

Putting your clients first.

Crossing the threshold of MAGII Wealth Management’s offices, the visitor is instantly at ease enveloped not only by the warmth of the surroundings, but more so by the genuine, caring vibe exuded by American Portfolios affiliated colleague Mark Gajowski and his team of seasoned associates. The embodiment of trust is palpable, and at once a balm for all who seek knowledgeable and compassionate care in financial planning.

FREE: How did MAGII Wealth Management come into being?

MARK GAJOWSKI: At the peak of what was considered the tech bubble, at the age of 24, I incorporated MAGII. Trying to accumulate assets under management was almost impossible because everyone was making money—triple digit returns, in fact. Suffice it to say, it was an interesting time to initiate my industry experience as an RIA.

FREE: What is MAGII’s value proposition?

MG: I run the business as the client would want to if it was theirs. We’re never going to care more about the client’s money than the client does—because it’s theirs. That being said, MAGII runs a pretty close second. We try to sit on the client’s side of the table as their CFO. At MAGII, we strive to provide the best service for each of our clients.

FREE: Tell us about your team and what makes your Long Island-based boutique practice so successful.

MG: There are three divisions at the firm: wealth management, third-party administrative services for qualified retirement plans and group health. Receiving my CFP credentials in 2002, I started the wealth management side of the practice. As a small business owner, I inherently understood that small businesses have needs on top of the day-to-day operational requirements—as with group health insurance, for example. Once that was added, we became involved with employee benefits initially for charter schools.

FREE: Creating a brand to effectively encompass each of the three business divisions is no small task.

MG: The business name is based on my initials. I also share my name with my father, so “II” was added to represent “the second,” hence the name MAGII. The branding story is pretty cool. In 2013, I was honored to be selected to participate in Goldman Sachs’ 10,000 Small Businesses Program, which is a collaborative venture between the Goldman Sachs Foundation and Babson College partnered with local community colleges. It is an entrepreneurial coaching program that both the business owner and the business undergo. Our new logo, which is made up of intertwining circles, represents the three divisions and was created collaboratively with one of my colleagues from this program. One of the best things to come out of my participation in the program was determining that the business needed a director of operations. This allowed me to work in my business and not on it. It was an eyeopening experience.

FREE: You joined AP in 2008. Tell us a little bit about why you decided to become affiliated with AP and what the transition for you was like.

MG: I originally affiliated with 1717 Capital Management, which later became Nationwide Securities, Inc. Not long thereafter, Nationwide ceased being a good fit for “career” advisors and I realized it was time to move on. I recalled hearing that several departing Nationwide advisors had landed at AP. Having lived all of my life on Long Island, I thought, “AP might be a better fit and it’s right in my backyard.” I fell in love with the freedom of having an independent model and being out on my own, and came on board.

FREE: At what point did you first meet CEO and President Lon T. Dolber and what were your first impressions?

MG: I met Lon the first time I visited AP. He is the antitheses of the stereotypical corporate CEO. He seemed much more accessible and much less formal than what I had experienced to that point. I’ve since learned that Lon is very involved in many of the same things that I’m involved in in terms of Corporate Social Responsibility (CSR). It’s a good fit all the way around.

FREE: What is the driving force behind why education and working hard for success are ingrained in your DNA?

MG: My family’s roots go back generations in farming. My grandparents came through Ellis Island, settled in Riverhead and established McKay’s Farm, which became one of the largest traditional farms in the area. As a result, I grew up with a highly-developed work ethic. I was the first in my family to go to college, which was a big deal for me. I felt there was a lot of pressure on my shoulders, but I felt a great deal of pride that I could create a business of my own and be successful. I think education is the future and that you’re either growing through learning or you’re dying. Education hits home for me. I love to read and my wife is a reading teacher. When speaking with clients, it is so important to me that they understand the process and that I understand their needs, as well. Education and sales go hand-in-hand.

FREE: How does improving service impact growth and sustainability in your practice?

MG: In “Awaken the Giant Within” by Tony Robbins, the concept of C-A-N-E-I really resonated with me. It stands for Constant And Never Ending Improvement. From a business owner’s perspective, I took that to heart and challenged the status quo rather than settling for mediocrity. We are human, after all; plus, there’s always some better, new process that the team strives to provide to our clients. I will never sacrifice client relationships or sustainability for growth because I believe that would be detrimental to the business. It’s a challenge to balance growth and service. Honestly, I would rather have a good, sticky business and do the right thing by the client than grow too fast sacrificing good, nurtured relationships. The MAGII team believes in our corporate culture, as well as our goals. In the office, we have a “Wouldn’t It Be Cool If” white board. The vision board concept is from the book “Double Double” by Cameron Herold. The belief is that you need to be able to see the possibilities of where you are going. If you can’t envision where you’re going and where you see yourself, how are you going to get there? Essentially, the vision board is a roadmap where ideas are shared and then vetted for appropriateness to the business; if approved, then they’re implemented.

FREE: Tell us how you’ve implemented resources in your practice and your assessment on whether you’re getting a return on investment.

MG: On the wealth management side, we use eMoney, which was suggested to us by AP. What I like about eMoney is that there is a client-facing portal where clients can make changes with some functionality and where we are also able to see what they have, even if it’s not something that we manage. In this way, we are able to provide our clients a more well-rounded, comprehensive view. Most of the larger client relationships we have, we are involved more as a wealth manager or CFO working alongside the client’s accountant, attorney and insurance broker.

FREE: Despite political involvement circling around the DOL fiduciary rule on retirement accounts, both the SEC and FINRA have been moving toward a fiduciary responsibility on the part of the financial professional. What are your thoughts on moving forward to manage these changes with or without a documented law?

MG: Being a CFP since 2002, I’ve always employed a fiduciary standard with every client. With or without legislation, MAGII’s core values are firmly entrenched in acting in the best interest of our clients. I believe that although we’ve worked really hard to build the reputation of MAGII, our success stems from being very attentive to everything that our clients need. Tying all of the financial pieces together in an advanced plan or within one of the business divisions is probably the fastest growing aspect of our shop right now. We’re doing things that nobody else is. The fastest growing industry right now is retirement plan exchanges. We built our own turnkey retirement plan exchange solution, which we plan to share with AP.

FREE: With the price compression challenges that we’ve faced in the industry, how have you been maintaining a steady revenue stream?

MG: In the absence of value, price becomes an issue. However, client retention is really great because we take our time to really get to know and understand every client’s individual needs. Although there has been price compression in the industry, the growth of our clients’ assets and the growth of our practice has been pretty steady. We built the business as multidisciplinary—if one area slows down in terms of revenue, another will pick up. At MAGII, 100 percent of the practice is fee-based. We also employ a tiered fee system, so we generally don’t get too much pushback on fees.

FREE: In what ways is AP supporting your practice?

MG: One of the biggest challenges in the industry is the aging population of advisors. Recently, I worked with Chief Legal Counsel Frank Tauches and my colleague Walter H. Brown, who heads up the retirement planning division, to draft one of the first succession plans on AP’s books. It became apparent to me that the process of researching potential advisors for the purpose of succession planning could be improved by having an advisor community marketplace to help put “like” advisors together. In this way, there is a level of comfort, not to mention continuity, making the transition almost seamless. It creates a better opportunity both on the way in and on the way out. The assets tend to stay and the clients are better served.

FREE: In 2016, you hosted two Virtual Enterprises International (VEI) students through the AP-VEI Internship Fellows Program. What was that experience like and are you interested in participating again in 2017?

MG: Last summer we had two great interns. They were so sharp—so smart and so interested in what we were doing. Anything they were asked to do, they were happy to do. We gave them projects and they just owned them. Technology was not an issue for them at all. They learned the technology platforms within days. The interns’ familiarity and ease with technology affords them a shorter learning curve as compared to a 40 year old. This summer, I am interested in hosting three interns to align with each of the three divisions at MAGII.

FREE: To what aspects of community outreach are you currently devoting your time?

MG: About three or so years ago, we created “MAGII Giveback Day.” My belief was that given enough time and enough money, everyone would give back. Giveback Day began as a free day off for employees to devote time to a charity or cause they supported. [The initiative has been] revamped as a team effort [whereby] a charity is selected and everyone from MAGII participates as a team. The charity benefits from the team’s involvement and it fosters team building outside of the office. Both my wife and I have lost family to Multiple Sclerosis. We are both actively involved in MS Hope for a Cure. In addition, I give time to my local fire department and serve as assistant coach on each of my three children’s sports teams.

FREE: The theme of this issue of FREE is “Charting Your Success.” In what ways has AP made a difference in the success of your business?

MG: AP provides the tools I need to run my practice, a savvy support team that’s there when needed, and a robust, scalable technology platform.

FREE: What motivates you?

MG: I like a challenge and, quite frankly, I want clients to be well served, the staff to be happy, and to be innovating, designing and challenging the status quo. It makes me happy when I feel that the energy radiating out is making a material difference in our practice and, by extension, to everybody we serve. You become something that’s bigger than the business.

FREE: What are your plans for the future, both personally and professionally?

MG: It’s very hard for me to unwind my professional life from the personal. In a perfect world, a long-term personal goal would be to try to develop the practice to a point where I can disconnect from it and it will continue to run well on its own, affording me more time for family. Although I’m very actively involved with my children’s homework, sports and so on, it would be nice to be able to do that and not feel the constant pressure of the business.

FREE: We’ll end with this next question. What is your favorite quote?

MG: Albert Einstein intoned, “If you can’t explain something simply enough, you don’t know it well enough.” If I find that I have a challenge explaining anything to a client, I take it as a personal loss and a lesson learned.

FREE: Thank you so much for your time.

MG: You asked a lot of great questions. Thanks for coming in.