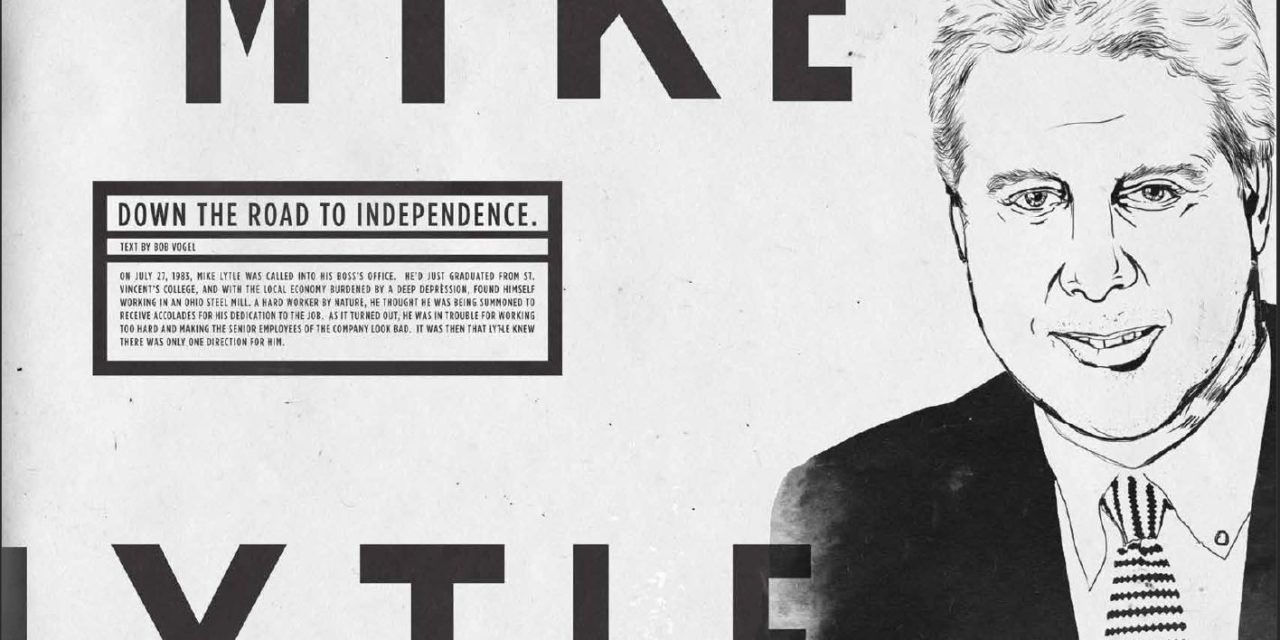

FREE 5.2 Feature – Mike Lytle

Many estimates for renewal energy growth were made prior to the onset of the COVID-19 pandemic and the collapse in oil prices. Worries are building that with cheaper oil and a sustained disruption in global supply chains, renewable energy may lose momentum.

To view the full article please register below:

FREE 5.2 Feature – Mike Lytle

Down the Road to Independence.

On July 27, 1983, Mike Lytle was called into his boss’s office. He’d just graduated from St. Vincent’s College, and with the local economy burdened by a deep depression, found himself working in an Ohio steel mill. A hard worker by nature, he through he was being summoned to receive accolades for his dedication to the job. As it turned out, he was in trouble for working too hard and making the senior employees of the company look bad. It was then that Lytle knew there was only one direction for him.

Fast-forward almost 30 years and Lytle is in his office as branch manager for the American Portfolios OSJ in Canfield, Ohio. With an extensive client list and 24 independent reps under his supervision, a typical workday for Lytle can quickly go in many directions. Fielding phone calls and working with reps on anything from simple questions to compliance, marketing, and

technology standpoints are a priority. He maintains a full schedule, working with personal clients in addition to managing reps in the field. He keeps up with online supervision and business

transactions, spending most evenings on the computer reviewing rep e-mails and online details with STARS, the homegrown APFS online supervisory tool.

“I’ve always been very competitive,” Lytle says. “I’m happiest when I’m working hard, so rising up to the challenge of a busy day is my fuel. It’s why I like being an independent broker.”

Although he thrives in this dynamic and challenging work environment, Lytle has a personable, easy-going manner. Perhaps this is the result of his Midwestern upbringing—the perfect mixture

of small town hospitality mixed with a strong and unyielding work ethic. The fact he was also an allstar athlete adds to the mix.

Raised in Youngstown, Ohio, Lytle grew up with a fierce competitive streak and a passion for basketball. These traits, combined with a 6 foot 6 inch frame and athletic prowess on the court, earned

him a full college scholarship. He credits his sports background for teaching him to enjoy challenges and to strive to excel in all areas of life.

This aspect of Lytle’s personality has helped him navigate the often dark and unpredictable road that independent financial advisors can find themselves on. But what’s unique about Lytle is that,

unlike many of his colleagues, he’s never worked in a captive, wire house environment. He credits his experience at the steel mill to why he gravitated away from that arrangement.

“I will never forget that,” he recalls. “It helped form an opinion that, with my work ethic, it is better to be independent.”

In 1985, Lytle was able to transition out of the mill and into a position as a rep for Premier Health Plan, a small HMO out of Warren, Ohio—a good fit for Lytle and for the clients he represented.

However, three years later, Premier was purchased by a massive conglomerate and everything, including his ability to work in the clients’ best interests, changed.

“The new company was looking for squeaky clean, white-collar business. The Northeast Ohio demographic is older and includes steel mill workers that might get hurt. The insurance ratings were horrible for this population and the company really didn’t want their business,” Lytle recalls. “So I hung up my own shingle and started Lytle & Company. Now I had the freedom to pick and choose the right company for my clients. I had a great business model and made very good money.”

With an affinity to go the extra mile for his clients, Lytle’s business started to evolve.

“Most of my clients were asking me about financial products and I wasn’t security placed. I had some friends in the financial business and I would call them up and say ‘hey, this customer wants to

do a 401(k) or an IRA.’ I was just trying to help my clients, but I was giving it all away. Then the light bulb went on.”

Lytle decided to branch out into financial services, while staying independent. He grabbed every financial magazine he could think of and started calling firms. Lytle signed on with Mariner

Financial, a small but independent company, and prepared to take his series 7.

True to his independent style, rather than take classes Lytle spent a couple of months studying for the exam in his basement. “Think about it, this was 1994 so it was all on books, you couldn’t

just look stuff up online,” he recalls. “It’s a study system I would not recommend.” The now outdated method worked, however, and he earned his series 7 license.

Lytle enjoyed working with Mariner because the company culture was based around the needs of an independent rep. Within a few years he passed his series 24—employing the same self-study

method—and with this managing license, started to bring reps under his umbrella.

In 1997, Mariner was acquired by Aegon Insurance, a large company out of the Netherlands. For Lytle it was like a bad case of déjà vu. “When the acquisition happened we lost our sense of culture

and the reps started to scatter.” Keeping in touch with his desire to be independent, he knew he needed to move on.

The same year, Lytle signed on with Questar, a new broker/dealer started by Mariner’s previous CEO that aimed to keep the culture at the forefront, just like his former B/D. It managed just

this for the next nine years, and Lytle called Questar home. He continued to build his client base and supervise his OSJ. Then, it seemed the inevitable fate fell upon him again; in 2006 Questar

was purchased by Alliance.

“Once again I found myself in the same boat. I knew it was going to be the death of our culture. Here I am with a lot of experience and emotion wrapped up in building client lists and bringing

on reps for companies with a personal atmosphere and culture, only to see them bought out by large impersonal companies.”

This time, Lytle teamed up with two other Questar managers—Rich Gerepka and Tom Perry—and together the trio began an extensive search for another broker/dealer.

“We made a pact to find a place to call home,” recalls Lytle. “We started by making a list of what we wanted; No. 1 on that list was culture.”

Because each of them had sizeable branch offices, they were being wined, dined and recruited like first round draft picks. “I had stacks of offers from broker/dealers; trips, money, incentives, anything to join their company. But money wasn’t my priority,” he remembers. “I wanted to find a company with a culture that was like family, one that wouldn’t be bought out.”

Lytle gives credit to Gerepka—who acted on a tip from a friend—for finding American Portfolios. In April 2007 the trio flew to AP’s home office in Holbrook, N.Y., and met with CEO Lon T. Dolber, Senior Vice President of National Sales Development Tim O’Grady and COO Dean Bruno.

“We saw that American Portfolios offered us the flexibility and technology platform to be successful, but mainly it was about the company’s culture,” said Gerepka. “We could see that American Portfolios understood what it meant to conduct business as an independent rep, and would support and nurture this need.”

Dolber further cemented their views of the firm. “I told them that it’s important to create shareholder value, but not at the expense of the company culture and everything that we have built

together,” he recalls.

It was everything they were looking for and all three signed on with American Portfolios. Gerepka acts as the branch manager for the APFS OSJ in Palm Beach Gardens, Fla., and Perry is the branch manager for the APFS OSJ in Indianapolis, Ind.

“With APFS I found a company and a culture I can work with, stay with and retire at without going through another impersonal buyout,” says Lytle. “The first thing I did when I got back was

toss out the two-foot high stack of offers from other broker/dealers. I officially started with APFS on May 25, 2007.”

The partnership has been very successful. The number of reps under Lytle’s supervision has more than doubled since he joined APFS, with the technology and culture playing an important role.

When Lytle has a prospective rep that he is thinking of bringing on board, he asks Dolber and O’Grady to give a webinar demonstration of the STARS system. When a rep sees how much more efficient their day can be when all the physical shuffling and shipping of paperwork can be replaced by a computer screen and a few clicks of a mouse, they usually sign on.

“Helping reps become successful and growing the business is my favorite part of the job,” says Lytle. He sees a lot of reps coming from large wire houses that had very restrictive product offerings

or managers dictating what they needed to sell every week. Lytle says being an independent rep is a unique experience because you can be totally objective with your clients.

“Success in this business is directly related to a rep’s passion to make a difference in their clients’ lives. If I got out of this business tomorrow, I would always choose to invest with an independent

rep.”

The STARS system also helps Lytle manage what he considers the most challenging part of the job—the battle to stay ahead of constant regulatory changes. “With STARS I can keep up with changes, and find or track anything I need online,” he says.

When it comes to caring for his personal clients, Lytle says the key is communication; he prefers to communicate the old fashioned way, by picking up the phone and speaking with clients at least

once a quarter. “Now more than ever it is important to stay in touch because people are barraged with a constant influx of media information telling them where they need to be invested, without knowing anything about them. Our job as advisors is to help clients filter the good information from the bad, help them understand the basics and the importance of a long-term investment horizon and stick with it.”

Lytle learned this lesson while growing up and watching his dad invest, primarily in blue chip stocks. “In 1987, when the stock market took a big dive, I said, ‘Dad what are you going to do now?’

He said ‘it’s a great buying opportunity, I’m buying.’ He was in it for the long haul and did well.”

At 50, life is about much more than just work for Lytle. He is a devoted family man with strong community ties. Lytle and Sue, his wife of 21 years, stay busy raising their 14-year-old daughter Sara, along with two cats and a dog. Sara has inherited her dad’s fierce spirit. “She is a freshman in high school and has already lettered in tennis and debate,” beams Lytle. “She just returned from competing in the Ohio State Debate Tournament, where she was up against juniors and seniors. She is already being recruited by colleges and offered scholarships.”

The family lives on seven acres in a house in Canfield that was built in 1865 and is almost completely off the grid. “We have our own natural gas well on the property—something that isn’t uncommon around here. We get free gas and a check every month,” he says. “I also ran a line to the garage, and to the gas grill. We have our own well, and a septic system. The only utility we have

is electricity. All I need is a natural gas car and I’ll be set.”

With strong local roots, giving back to the community is important for Lytle. He is in his eighth year serving on the zoning board, working to help balance residential and commercial needs for Canfield Township. “Not always an easy task!”

And although he hasn’t played basketball since he was 40, Lytle still misses the physical competition. The sport he enjoys most these days is recreational road cycling. “Around here we have an amazing system of bike trails built on old railroad beds,” he says. Lytle also enjoys spending time outdoors, fishing the local streams and ponds. To find balance and keep things in perspective, he goes for a long walk every day—no distractions, no cell phone—to clear his head and recharge his batteries.

A full work life, family life, staying physically active, plus volunteering to help improve his community—for Lytle, this lifestyle represents a challenge and an opportunity to max out his work effort. Not much has changed since 1983, and now that he’s found his permanent home with American Portfolios, the same can be said for the future of Lytle & Company.