FREE 13.2 Q&A: Diana (Curbelo) Curran

American Portfolios (AP)-affiliated financial advisor Diana Curbelo is among a group of women representing just 14 percent of the total investment professional population. She will soon be among 25 percent of women holding their Certified Financial Planning (CFP) designations. Yet, after 13 years in the business and a thriving practice with over 500 clients and close to $90 million in assets under management to show for it, Curbelo is just beginning.

To view the full article please register below:

FREE 13.2 Q&A: Diana (Curbelo) Curran

American Portfolios (AP)-affiliated financial advisor Diana Curbelo is among a group of women representing just 14 percent of the total investment professional population. She will soon be among 25 percent of women holding their Certified Financial Planning (CFP) designations. Yet, after 13 years in the business and a thriving practice with over 500 clients and close to $90 million in assets under management to show for it, Curbelo is just beginning. At 38, with plenty of runway in front of her, she is the new generation of investment professionals setting the standard for howto serve an increasingly diverse and wealthy investing public, thus shaping the future of financial services.

FREE: Tell us about your formative years and how they shaped who you are now.

DIANA CURBELO: I was born in Puerto Rico and came to the U.S. at four years old. I grew up in Bay Bridge, Brooklyn. We went to stay with my dad’s brother for a little bit until we found our own apartment in Brooklyn. I remember not wanting to leave Puerto Rico. I was very upset about that. And now, every time I go back to visit, I think how grateful I am for the opportunities afforded me because of that move.

FREE:What was it like being raised in Brooklyn?

DC: I grew up with [my sister and] a single working mom. She was a social worker for a long time and had a nice career doing that. I was in the top classes in elementary and junior high school. The schools were great. After high school, I wasn’t exactly sure what I wanted to do, so I started taking a few computer science courses in college. And, if I wanted things, I had to buy them on my own, so I got a job.

FREE: Is that when you started working with AP affiliated colleague Len D’Angelo at Penn Plaza?

DC: Well before working at Penn Plaza [a broker/dealer], I was at an insurance brokerage firm. When I left them, they gave me their contacts in New York City and one of them was Len D’Angelo. I continued college while at Penn Plaza; I went to two city universities—one of them was the College of Staten Island and the other, Baruch College. When I started at Penn Plaza in 2003, I was still doing computer science, but realized I wanted to do the finance route. In 2010, I graduated from Baruch with a bachelor’s in business administration, with a focus on finance and investments.

FREE: That’s quite an accomplishment, working and going to school at the same time, not to mention paying for it.

DC: Yes, I believe it’s one of the top business schools in the Northeast. But I’m thankful because I don’t have any loans. Going to CUNY afforded me a great education and no student debt, which so many of my clients have.

FREE: So how did you evolve into becoming an investment professional?

DC: I started out as an assistant for Len and, after one year, he suggested I get my licenses. After two years, I had my Series 6 and 63, and got my insurance license, as well. There were about 70 advisors affiliated with Penn Plaza at the time and I was processing a lot of their business; it was all direct mutual funds and annuities. But I enjoyed the markets; I enjoyed working with [Len’s] clients. And, he just said to me one day, “You know, you can do this.” He was the first person to see the potential in me as an advisor. He just took me under his wing.

FREE: Do you recall your first solo appointment?

DC: Yes, that was interesting. I went up to see a lady in the Bronx; she was a nurse. I took the train up there—I worked in Manhattan and lived in Brooklyn, so it was quite a way. I did college plans for her grandchildren, and built a very nice relationship with her over the years. It was great. It came naturally to me and I found that I wasn’t afraid of helping people reach their goals, talk about their money and what they should be doing with it.

FREE: And 13 years later, when you look at the fruits of that piece of business you did, what are your thoughts about that?

DC: It’s amazing to see the progress over the years. People look at me when I say that and think, “Well, you’re just a baby.” But I’ve been doing this a long time. The [young] grandchildren of that first client have already graduated college and I was able to help them do that. That’s meaningful to me.

FREE: Starting in 2008, having weathered one of the worst crises in financial markets history, what was it like building your book of business at that time?

DC: I can’t believe it’s been over 10 years since then. I was only licensed for a couple of years at the time, but luckily a lot ofmy clients had various protections on their accounts since we did a lot of annuities. There was something that Nationwide had at the time called Capital Preservation Plus Lifetime Income (CPPLI). A lot of the bigger accounts that I was opening had preservation of capital. It had that guarantee where, if the market went down, they wouldn’t lose any money. That was a blessing in disguise at the time. And, for the clients who were in mutual funds, I encouraged them to hang in there. The ones who did stay in thank me every day.

FREE: You were fortunate to be surrounded by good mentors, which leads to your colleague, former AP affiliated financial advisor Ira Bernstein, whose book of business you partially acquired.

DC: I learned a lot from Len and Ira. Ira has recently retired, but when I first started with Penn Plaza, he was one of the top producers there who built a very substantial book and niche with the New York City school teachers, half of which I took over in January 2019. While he’s totally out of the investment side, Ira still does the pension consultation here and there. He participates in the bi-annual school teacher pension seminars. And, if there’s a rollover to be done, he will defer that to myself or [AP affiliated financial advisor] Greg Selg [co-successor of the book]. But little by little, he taught me the ins and outs of their pension system. Since then, I’ve done thousands of pension consultations.

FREE: So how did you come to AP?

DC: Going back to 2009—Sept. 4, 2009—was when we merged with American Portfolios; it was a scary time in the industry. [As a small broker/ dealer], it was hard to keep up with the compliance, so Len downsized—I was the only staff member he kept. There were a lot of changes, but we did enjoy the new technology AP offered, and the way of doing things got a lot easier. I hung in there and it really paid off; it was the best decision I ever made.

FREE: What areas/service offerings at AP have been helpful in growing your business?

DC: As I mentioned earlier, all the business being done at Penn Plaza was direct. Around the time of the merger with American Portfolios, Jared McGill [then a home office employee of AP] showed up on the scene. He came out and he trained us on STARS. A year or so later, he came onboard with us as an advisor. Back then, he would talk to me about Pershing and advisory, but I really wasn’t listening. A year or two later he partnered with [AP affiliated financial advisor] Greg Blank. He played a very important part in shaping the way I do my business. Then, in 2015, the sales and new business development team started coming around to talk about advisory business. It was painful learning the new process because, from a paperwork standpoint, I was already so used to the old process. It took some time, but I got there, thanks to the help of [Advisor Support Specialist] Tina Barry in the Advisor Support Center (ASC),

who’s always been very patient with me. Overall, the ASC has been a crucial part in helping with the transition of my new accounts from Ira. They’re always super patient; I’d probably be lost without them. [Vice President of New Business Development and Advisor Relations] Dave Molter has also been great, as have [Business Services Leaders] Jesse McGill and Jake Owens, and [Business Services Specialist] Jonathan Poore.

FREE: So, at this juncture in your practice, who do you serve in the marketplace and what is your business mix?

DC: The bulk of my business is a niche in the New York City school teacher system. I’m doing more advisory: it’s about 70 percent advisory using third-party managers and 30 percent annuities, with 100 percent advisory in new business and 10 percent with existing clients. With this new book I acquired in January, I’ve been trying to focus on converting that.

FREE: According to the Federal Bureau of Labor statistics, only 32 percent of financial advisors are women. Why do you think that is and what advice might you give a young woman considering this profession?

DC: If we look back to our parents’ or our grandparents’ generation, not too long ago the only women that worked on Wall Street were secretaries. That began to change as women were entering the business world and workforce. They weren’t going into finance; they were doing things like becoming a teacher. The only professional women I really saw were teachers. If we want to attract more women [in financial services], we need to start getting in front of young women as they’re thinking about what careers they want and let them know they can do this. And for young women considering the profession, if you like working with people, I say go for it. For me, there’s been nothing more rewarding than that.

FREE: Do you think maybe women perceive it as a sales role or it being too numbers-focused?

DC: The profession is relationship focused. I view myself as a financial planner, not a money manager, and I’m not selling shoes or pocketbooks— I am helping people reach their goals. When I talk to Ira’s clients for the first time, most of them are happy to hear from me. It’s a good feeling knowing that. And, for the handful of people who do not give me the warm reception I deserve, it’s their loss. One of the things Len and Ira always said was, “Every ‘no’ gets you closer to a ‘yes.’” Maybe they were in a bad mood that day, so another time at a later date they’ll say yes. And if not, that’s fine. I tell them, “I’m here for you if you need me. Have a nice day.”

FREE: Your recent nomination to the AP Advisor Council (APAC) and chair of the APAC marketing subcommittee has immersed you in several projects. Can you tell us a little about what you are working on?

DC: In late 2017, Dave Molter askedme if I wanted to be on the practice management APAC subcommittee. He told me it involved discussing ideas [among peers] about how to better manage their practices and give insight to help AP help us. I thought that was a great idea. I never say no to anything.

FREE: And the projects you are working on?

DC: We’re working on some lead marketing projects. [Vice President of Marketing Strategy] Kimberly Branch is at the helm and she’s excellent. We put together a branding brochure, which talks about why and how an advisor should consider branding themselves; a white paper on creating an advisory board, and how that can help a colleague build their practice; and building a niche market, my favorite [see pg. 42]. There we talk about the research showing how advisors with niche practices have about 25 percent more revenue, which I can attest does indeed work.

FREE: Industry studies have revealed that the investing public has become very financially savvy over the years, with greater expectations for value-added services. Do you sense this change in heightened demand and awareness among your existing and prospective clients?

DC: Yes. You know, one of the first questions I get asked now is, “What are your fees?” Back when I first started [as an investment professional], I was rarely asked that. For the most part, I charge 1 percent and I rarely move from there unless the account is of a certain size. Some people will try to get me to come down and usually I say no because I feel like I offer value to them. I’m here whenever they need me to give them advice on their investments or many other avenues. I know what I’m worth, and I really don’t get any pushback on that. And when I complete my CFP, that will hold even truer, I think.

FREE: Who or what has been your greatest source of inspiration, both personally and professionally?

DC: My mom has always pushed me to maximize my potential and she would always make sure I stayed on track whenever I veered off a bit. In fact, she would drive me to my appointments and wait for me outside. Talk about support, right? She instilled confidence in me and to always be grateful. I think gratitude is something that’s very important and sometimes people don’t recognize that. Always be grateful, appreciative, thank people and don’t expect things.

FREE: With the rigors of a growing practice, how do you manage a healthy work/life balance?

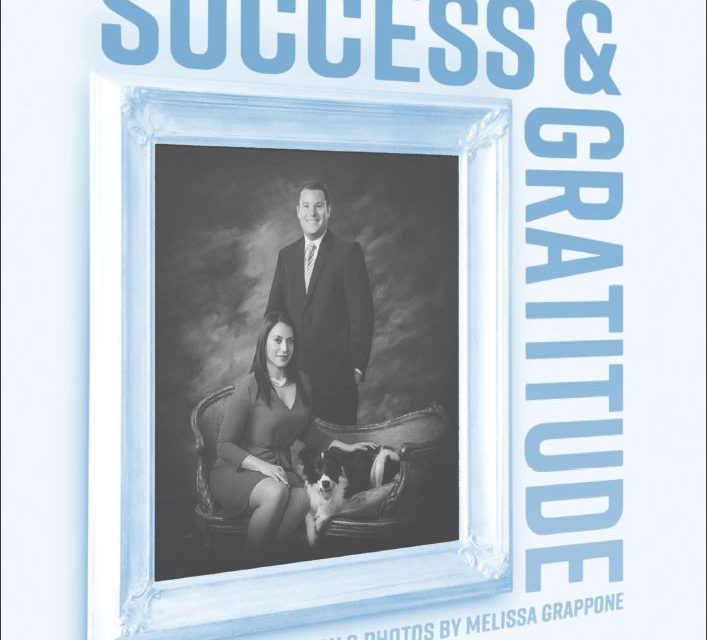

DC: One of the things I like to do when I first wake up is workout. It sets the tone for my day and keeps me energized. Another thing I swear by is having a cleaning lady. It helps me dedicate more time to do work from home. I’m focused on the job, on my CFP classes, my fiancé and my dogs.

FREE: So, tell us more about your canine companions.

DC: They’re black-and-white Border Collies named Josephine and Bailey. Josephine is five and Bailey is two. I got Josephine at two months old and we bred her three years later. She had eight puppies and Bailey was one of them. She’s a great mom.

FREE: Congratulations on your recent engagement. How are the wedding plans going?

DC: Thank you. We’ve set a date and secured our venue—we’ll be getting married in the fall of 2020. Peter is very engaged in the planning, which I’m very happy about.

FREE: Your fiancé is a New York City police officer, correct?

DC: Yep, he is. He’s a sergeant with the NYPD in the Mounted Unit.

FREE: How cool. One final question. This issue of FREE’s theme is about leaving a legacy in your practice. As someone with a lot of runway ahead of them, what do you envision your legacy being?

DC: I’ll answer the question this way … I’d like people to say that I was there for them, that I helped them to achieve their goals, they trusted my advice and it changed their lives.

FREE: You might say it’s a legacy both professionally and personally. Enjoy what’s ahead for you.

DC: Thank you so much.