FREE 14.2 Feature: Donna LaScala

At ease with a broad range of topics, American Portfolios (AP) affiliated financial advisor Donna LaScala speaks of farm-to-table dining and Long Island’s Revolutionary War history as she walks through Baxter Pond Park, skirting along the edges of Port Washington’s town dock. LaScala’s passion for local history and the place she calls home give proof she is an old soul, just as passionate about the past as she is about the present and the future that lies ahead.

To view the full article please register below:

FREE 14.2 Feature: Donna LaScala

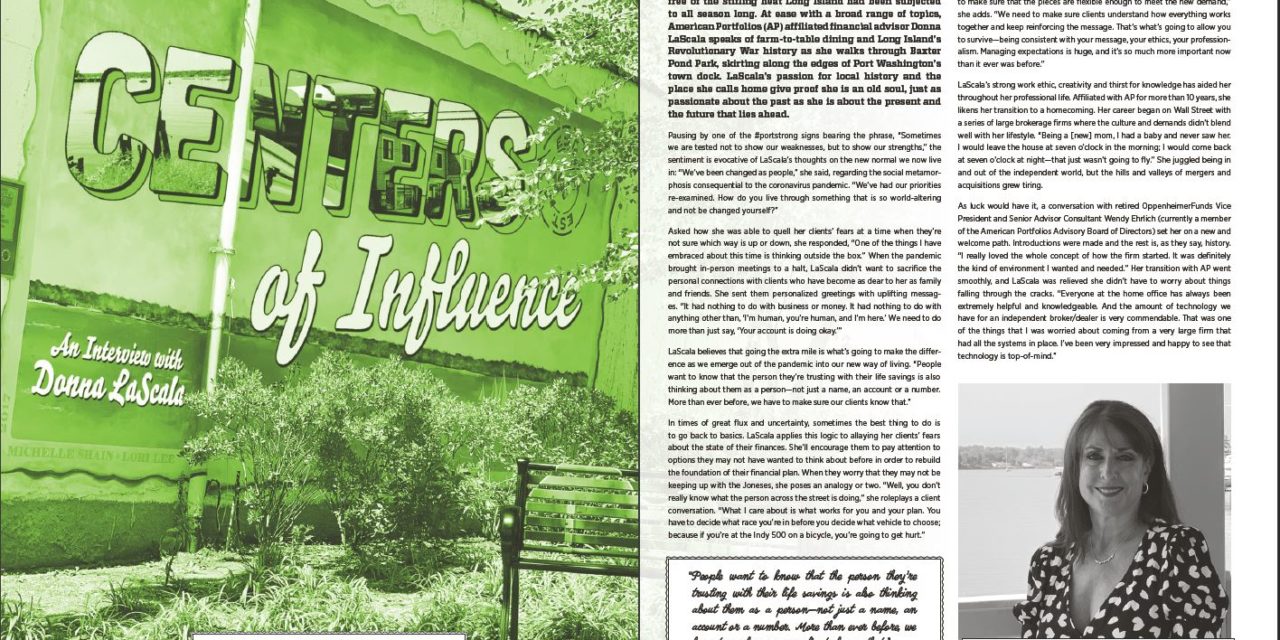

Centers of Influence

It had rained overnight, giving way to a summer day free of the stifling heat Long Island had been subjected to all season long. At ease with a broad range of topics, American Portfolios (AP) affiliated financial advisor Donna LaScala speaks of farm-to-table dining and Long Island’s Revolutionary War history as she walks through Baxter Pond Park, skirting along the edges of Port Washington’s town dock. LaScala’s passion for local history and the place she calls home give proof she is an old soul, just as passionate about the past as she is about the present and the future that lies ahead.

Pausing by one of the #portstrong signs bearing the phrase, “Sometimes we are tested not to show our weaknesses, but to show our strengths,” the sentiment is evocative of LaScala’s thoughts on the new normal we now live in: “We’ve been changed as people,” she said, regarding the social metamorphosis consequential to the coronavirus pandemic. “We’ve had our priorities re-examined. How do you live through something that is so world-altering and not be changed yourself?”

Asked how she was able to quell her clients’ fears at a time when they’re not sure which way is up or down, she responded, “One of the things I have embraced about this time is thinking outside the box.” When the pandemic brought in-person meetings to a halt, LaScala didn’t want to sacrifice the personal connections with clients who have become as dear to her as family and friends. She sent them personalized greetings with uplifting messages. “It had nothing to do with business or money. It had nothing to do with anything other than, ‘I’m human, you’re human, and I’m here.’ We need to do more than just say, ‘Your account is doing okay.’”

LaScala believes that going the extra mile is what’s going to make the difference as we emerge out of the pandemic into our new way of living. “People want to know that the person they’re trusting with their life savings is also thinking about them as a person—not just a name, an account or a number. More than ever before, we have to make sure our clients know that.” In times of great flux and uncertainty, sometimes the best thing to do is to go back to basics. LaScala applies this logic to allaying her clients’ fears about the state of their finances. She’ll encourage them to pay attention to options they may not have wanted to think about before in order to rebuild the foundation of their financial plan. When they worry that they may not be keeping up with the Joneses, she poses an analogy or two. “Well, you don’t really know what the person across the street is doing,” she roleplays a client conversation. “What I care about is what works for you and your plan. You have to decide what race you’re in before you decide what vehicle to choose; because if you’re at the Indy 500 on a bicycle, you’re going to get hurt.”

“When something like this happens—even if it’s not a pandemic—we need to make sure that the pieces are flexible enough to meet the new demand,” she adds. “We need to make sure clients understand how everything works together and keep reinforcing the message. That’s what’s going to allow you to survive—being consistent with your message, your ethics, your professionalism. Managing expectations is huge, and it’s so much more important now than it ever was before.”

LaScala’s strong work ethic, creativity and thirst for knowledge has aided her throughout her professional life. Affiliated with AP for more than 10 years, she likens her transition to a homecoming. Her career began on Wall Street with a series of large brokerage firms where the culture and demands didn’t blend well with her lifestyle. “Being a [new] mom, I had a baby and never saw her. I would leave the house at seven o’clock in the morning; I would come back at seven o’clock at night—that just wasn’t going to fly.” She juggled being in and out of the independent world, but the hills and valleys of mergers and acquisitions grew tiring.

As luck would have it, a conversation with retired OppenheimerFunds Vice President and Senior Advisor Consultant Wendy Ehrlich (currently a member of the American Portfolios Advisory Board of Directors) set her on a new and welcome path. Introductions were made and the rest is, as they say, history. “I really loved the whole concept of how the firm started. It was definitely the kind of environment I wanted and needed.” Her transition with AP went smoothly, and LaScala was relieved she didn’t have to worry about things falling through the cracks. “Everyone at the home office has always been extremely helpful and knowledgeable. And the amount of technology we have for an independent broker/dealer is very commendable. That was one of the things that I was worried about coming from a very large firm that had all the systems in place. I’ve been very impressed and happy to see that technology is top-of-mind.”

Through Ehrlich, she was introduced to Brad Goldner (Goldner Financial Group, Northport, N.Y.), who to this day remains her OSJ. Initially “I moved into his offices in Westbury. Over the years, his team and his people have made my life so much easier. It was such a nice environment. If I had a question, I could walk down the hall and there was always somebody there. Being in my own office now is great, but there is definitely something to be said about working with a team and having people that have your back on a very personal level.” It was that personal connection that saw LaScala through a very complicated divorce, something she knows more about than the average person.

In addition to earning her Registered Financial Consultant (RFC), International Association of Registered Financial Consultants (IARFC) and Certification in Long-Term Care (CLTC) designations, LaScala is a Certified Divorce Financial Analyst (CDFA). While affiliated with a former independent broker/dealer, she rented office space at a law firm operated by five young partners, all with different disciplines. “It was a very natural way to get referrals because I’ve always believed in the center of influence way of doing business. As a financial advisor, if I have an attorney that I’m going to recommend, and you trust me as your financial advisor, you’re more likely to trust that person.” She forged a symbiotic relationship with the law firm’s divorce attorney, who introduced her to clients she still has some 20-odd years later. Concurrently, LaScala joined The Women’s Financial Group, an organization formed by established businesswomen to help fledgling women in business. The group consisted of “insurance producers, financial advisors, people in banking and mortgages, and real estate—and a divorce mediator. I had no idea what that meant at the time, but I became fascinated with the process.”

As a means of bringing her clients who were going through and transitioning out of divorce more process knowledge, LaScala became trained as a divorce mediator. In rapid succession, she became collaboratively trained as a financial neutral and earned her CDFA. From there, “the floodgates opened. When people see that you’re really dedicated to the field, they trust you even more.”

When most people make the difficult decision to get divorced, they assume they will have to navigate the court system. Known as an alternative dispute resolution methodology, the collaborative process offers a middle ground between mediation and litigation, where couples are assigned a team of people that work with them from the beginning of the process to its close. The team is comprised of two attorneys, representing each member of the couple; a financial neutral; and a family specialist/mental health professional. “As a financial neutral, I represent each member of the couple as a neutral party, helping them develop a roadmap of how their marriage, their family will look so they can continue forward. The litigation process just does not have that mindset.” She relates the stark contrast between litigation and mediation to something her friend, attorney and colleague Liz Vaz, said: “When you’re in litigation, your attorney stands in front of you with a sword and a shield. When you’re in mediation or collaboration, the legal professional stands next to you, shoulder to shoulder.”

To ensure a strict code of ethics is adhered to, LaScala and her colleagues sign a participation agreement with the couple to establish they will work together to reach a mutually beneficial outcome; and if they decide to stop the process, the professionals agree they will not work with the couple in any manner, thus eliminating any conflict of interest.

In addition to her work with collaborative colleagues, LaScala is a member of the New York State Council on Divorce Mediation and the Long Island Collaborative Divorce Professionals, a group formed to educate those unfamiliar with the collaborative process. Their hope is to shine light on the more humane method of dissolving a marriage. Despite all the time and money many couples invest, the staggering statistic is that, of all litigated divorces on Long Island, 95 percent of them get settled out of court. “The whole idea of ‘you’re going to have your day in court’ is not like on TV. It’s more of a wash, rinse, repeat process. You do the same thing over and over again until all parties say, ‘Okay, we just have to settle this.’

LaScala speaks from experience. “When I was going through my divorce, I was sitting in the courthouse next to a woman silently crying and I said, ‘Are you okay?’ She said, ‘No, I’ve been doing this for five years. I can’t do it anymore.’ Then, a man sitting across from us, said, ‘Five years, you think that’s bad? I’m going on 10.’ It’s a broken, overwhelmed system.”

After her divorce, LaScala’s life shifted to being a single woman with obligations to her two daughters, Alexandra and Samantha, herself, her practice and her clients. For some, that might be enough responsibility to bear; but the more she saw women entering divorce with little to no understanding of financial matters, she considered it her duty to educate them. “I was finding that a lot of my clients were women who had always left the financial decisions up to their spouse.” This was relatable more so because of LaScala’s family background. “I come from a very large Italian family; my mother was one of 10. There were nine girls, one boy. I had 23 first cousins, 17 of them were women. I’ve been around women all my life and it became a mission. I started seeing the disparity of financial know-how between men and women and said, ‘Okay, I can’t allow this to happen. I need to find a way to help these women move on.’ The first thing they think is, ‘How am I going to be able to live?’” She sits with them for hours, mapping out plans they can grasp and hold on to. “These women have said, ‘I thank God I met you because I feel so much better now.’ To me, that is worth everything. If I can save one woman from having to go through years of not knowing how she’s going to move forward, then I’ve done my job.”