Looking to Our Past to Guide Our Future

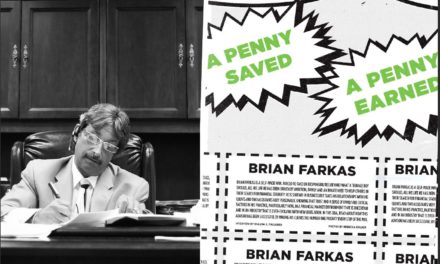

American Portfolios (AP) marked its 20th anniversary this last year, triggering some reflection on our two-decade journey and where the future may take us.

To view the full article please register below:

Looking to Our Past to Guide Our Future

American Portfolios (AP) marked its 20th anniversary this last year, triggering some reflection on our two-decade journey and where the future may take us.

It’s truly difficult to describe the experience of opening our doors for business on the same day the nation was rocked by the human tragedy that was 9/11. Starting a new business in the best of circumstances is challenging enough; doing so on a day in which so many lives were lost is unfathomable.

What the nation discovered about itself, we at AP also discovered within ourselves. We found a resiliency and resolve to overcome and move forward; it was a strength that served us well in the years that followed.

AP has grown into a leading full-service, independent broker/dealer and registered investment advisor (RIA) because we built our business on a simple, yet critical proposition—to create value for our employees, the financial advisors we serve, our community and our shareholders.

Equally important to having a core value proposition was remaining faithful to its purpose through 20 years of extraordinary challenges and changes.

One way we’ve remained true to our principles over these many years has been to constantly remind ourselves of their significance so that they never get lost amidst the regulatory and technical challenges our business has experienced over the last two decades.

At AP, we are:

-

- Galvanized by a Just Cause—Our defining passion is American Dreams. It is a noble pursuit to help people gain the financial independence they need to realize their dreams, whether that’s

funding their children’s college education or starting a foundation to change the world. - United by a Mission—Our mission is simple. American Portfolios supports its investment professionals in helping people achieve their American Dreams.

- Guided by Core Values—We have adopted four such precepts that keep our organization grounded:

- Nurture—Each and every day we will cultivate a thriving workplace, investing in our team(s) so they may realize their personal and professional dreams, all while instilling in them the desire and an ability to help others reach theirs.

- Launch—We will set our sights high above the fray, questioning “why” and answering “how” at every turn for the benefit of our advisors and their clients, to deliver a spectacular customer

service experience. - Give—As corporate citizens, we will make it our purpose—both narrowly and broadly—to constantly improve the lives of ourselves and others because, in a world of infinite problems and possibilities, dreams realized beget new ones.

- Aim—With an eye toward a sustainable future, we will recognize the capital interests of every AP stakeholder—employee, advisor, client, community and shareholder—creating long-term well-being and value for all.

- Galvanized by a Just Cause—Our defining passion is American Dreams. It is a noble pursuit to help people gain the financial independence they need to realize their dreams, whether that’s

Changes in the Wealth Management Landscape

Given many changes the industry underwent during the last 20 years, I would argue changes over the next decade will be more numerous, develop at a faster pace and be more profound.

While change presents challenges, it also represents an opportunity to reach new heights of professional success and satisfaction. Consider how the landscape is already shifting where these changes may alter the way advisors practice their craft in the following ways:

- ESG Investing—A new generation of investors will demand that investments they make align with their values, requiring advisors to develop new knowledge and upgrade their investment process to reflect investors’ new preferences.

- Generational Wealth Transfer—It is not unrealistic that many advisors will see a substantial share of their client assets transferred to their clients’ children. Without a strategy to connect with this generation, advisor practices may inevitably shrink.

- New Investor Mindset—The future investor class does not see investing through the same lens as the Baby Boomer generation. Advisors will need to become aligned with the different attitudes and expectations these new investors bring to the table.

- Increased Competition—From Decentralized Finance (DeFi) to robo-advisors, financial professionals will face an onslaught of new competitors that will serve to drive costs lower, bring

servicing standards higher and siphon assets from full-service investment professionals. - Heightened Regulatory Burdens—New regulations will add cost, alter the way advisors interact with clients and affect their service offering. For instance, the idea of justifying an advisory fee with a bundle of other services (i.e., financial planning) may no longer be acceptable to regulators. There may come a day when such services must be priced on an a-la-carte basis.

Positioning AP and its Affiliated Financial Professionals for the Future

Disruption in the financial services industry can be unforgiving, and never more so is it for businesses that fail to adapt to a changing landscape. For advisors to thrive amidst the monumental changes that lie ahead, they will need to transform their practices in several important ways:

- Reimagining their Pricing Model—One essential response must be finding a more wide-ranging way of managing clients’ assets. As fees shrink, practices not set up to scale their business will see their revenues weaken accordingly, denting income and practice value. Developing model portfolios, assigning clients to the models and then managing them allows advisors to more easily add clients and overcome revenue erosion in a way that a non-scalable practice cannot. Advisors will also need to find ways to develop new sources of revenue, which may range from charging for financial plans to creating a subscription model or charging hourly fees for a specific skill set (i.e., divorce planning or business succession services).

- Developing New Skill Sets—When robo-advisors can create well-diversified portfolios of inexpensive index funds at rock-bottom costs, advisors will need to compete more than ever on value. That may mean pursuing specialized credentials around important financial planning concerns, such as college planning, charitable foundations, divorce planning or liability-driven investing.

- Effecting Change in the Community—While many advisors are positive social forces in their communities, being an engaged citizen will become table stakes to attract a new generation of investors. Advisors will not be solely evaluated based on their investing prowess or powerful tools; their involvement with social issues and charitable causes will affect whom investors choose to manage their assets.

The advisor is not the only one who will need to adapt to these changes.

AP must do so, as well. We believe the strategy that positions AP for the future must align with how the advisor will need to evolve. We recognize that change must be in concert with our advisors, for the failure by one to adapt becomes a failure for both.

Accordingly, here is how AP is aggressively positioning itself to help advisors get ready for the future:

- Eliminating Friction in the System—The days of an advisor or sales assistant acting as an intermediary between a client request and service execution needs to change. New, highly intuitive technology is at the heart of how this may be accomplished. Where fintech coins such trending advances as a “digital transformation,” I like to think of it more as a cultural reformation for AP.

- Based on invaluable feedback from our advisors and their clients, at their behest, AP has been—and continues to be—busy at work creating efficiencies in business processes that eliminate friction in the critical path. An example of this is AP’s self-registration roll-out last October of Client Access. Not unlike travel or banking, this broad, self-service capability has the dual benefit of providing a more satisfying customer experience and a reduced administrative role for the advisor.

- Facilitating the Build-Out of New Revenue Opportunities—Through our Advice Pay technology, advisors have a tool to bill for services, such as employee benefit reviews or social security planning, as well as making their new fee-for-service initiatives simple, seamless and profitable.

- Reducing Costs—While scalability is an advisor’s most effective response to fee compression, we understand that lowering advisors’ platform expenses must be an unflagging pursuit.

Much like the recently renegotiated services contract with our clearing firm, Pershing, we will continue to look for ways to reduce costs for both the firm and the advisor, not to mention creating more transparency for investors.

Similarly, as our efforts move more clients toward e-delivery and greater self-service, this will help reduce expenses and improve service overall. As always, the support of our advisors in migrating clients to self-service will be instrumental to everyone’s success.

Like so many of you, my career has been subject to the tectonic changes within our industry, with numerous examples of companies that disappeared because they were unable or resistant to adapting. Examples abound, from full-service brokerages in the wake of May Day—the elimination of fixed commissions—or the many fine mutual fund companies that faded into history following the rise of index funds.

Though there was industry carnage when change upended the comfortable status quo, in every instance the industry that emerged was bigger, stronger and more important to the American public. That knowledge makes me extraordinarily optimistic about the next 20 years—with one caveat … that is to accept being part of a future that demands we evolve with it.

Here’s to a future fulfilling many more American Dreams.

Please reference disclosures: https://blog-dev.americanportfolios.com/disclosures/