Three Investment Lessons from the Coronavirus Pandemic

The coronavirus (COVID-19) impact on the market has been unsettling. Uncertainty regarding its spread and ultimate economic impact has resulted in exceptional price volatility. Learn more now.

To view the full article please register below:

Three Investment Lessons from the Coronavirus Pandemic

The coronavirus (COVID-19) impact on the market has been unsettling. Uncertainty regarding its spread and ultimate economic impact has resulted in exceptional price volatility. While we don’t have any special insight into these two unknowns, we do believe that there are several important takeaways for advisors and clients alike.

Lesson 1—Diversification Still Works

Diversification can, at certain points in the market cycle, be frustrating. Allocations in cash and bonds can be a real drag on portfolio returns in times when stocks appear to be on a smooth ride ever upward. It takes times like these to remind investors why diversification is so important.

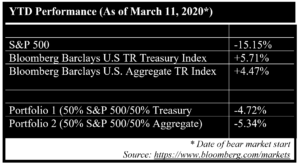

Here’s a quick illustration to show how diversification worked to protect client portfolios.

As the table above suggests, a well-diversified portfolio has helped clients weather one of the most volatile periods since the 2018 fourth-quarter stock market implosion. While the headlines may be screaming “disaster,” clients’ first-quarter statements will reflect less frightening results.

Lesson 2—Retirement Income Plans Require Reliability

Retirees and near retirees expecting to withdraw a pre-determined percentage from their portfolio, irrespective of market conditions, are confronting perhaps the greatest risk in retirement—sequence of returns risk. Drawing down on a portfolio that is declining in value is the surest route to outliving retirement assets.

It’s time to rethink retirement income strategies to consider how annuities can provide predictable, guaranteed income, regardless of market conditions. Annuities serve not only to deliver reliable income, but they are a source of enormous psychological comfort during periods of sharp market declines. It may also be useful to see how a portion of the portfolio can be dedicated to dividend-paying stocks to supplement the guaranteed income of Social Security, an annuity and any pension an individual may have.

Lesson 3—Turn Off the TV

For an industry whose motto is “If it bleeds, it leads,” hyperventilating about a “crisis” is to be expected. Media attract audiences through sensationalism; it’s their business model. Of course, responsible journalism exists, but investors ought to limit their viewing of general and business news since the steady diet of “doom and gloom” can lead to ill-considered investment decisions.

It is during times like these that advisors evidence their ultimate value by comforting clients, keeping them focused on the long-term and preventing fear-based decision-making.

Please reference disclosures: https://blog-dev.americanportfolios.com/disclosures/